Market Update: 11 May 2020

It’s indeed interesting when a report of 20million people unemployed equates to a stock rally of >2% including today, but here we are. The rationale of the move is more to do with it being lower than forecasts and the expectation for things to get better from here. Of course, they are… we are seeing reopening in many parts of the world – but where Wall Street is miles apart from Main Street may just be the persistence of high unemployment – it also may be demographics.

If the majority of those who can’t work are due to their roles not permitting a Work From Home opportunity, it may be more reflective of manual labour vs those who simply log in online. It does have implication for sentiment on both Streets… those who are working from home, sharing pics of their teams on Zoom – blissfully unaware of the implications to others as they live in their work bubbles vs those who can’t even get a job interview as no-one’s in the city. It makes more sense then that those who are on a subsistence living aren’t about to start trading stockmarkets, but those in their safe cocoons can afford to buy cheap stocks – because hey, they saw this work well during the GFC.

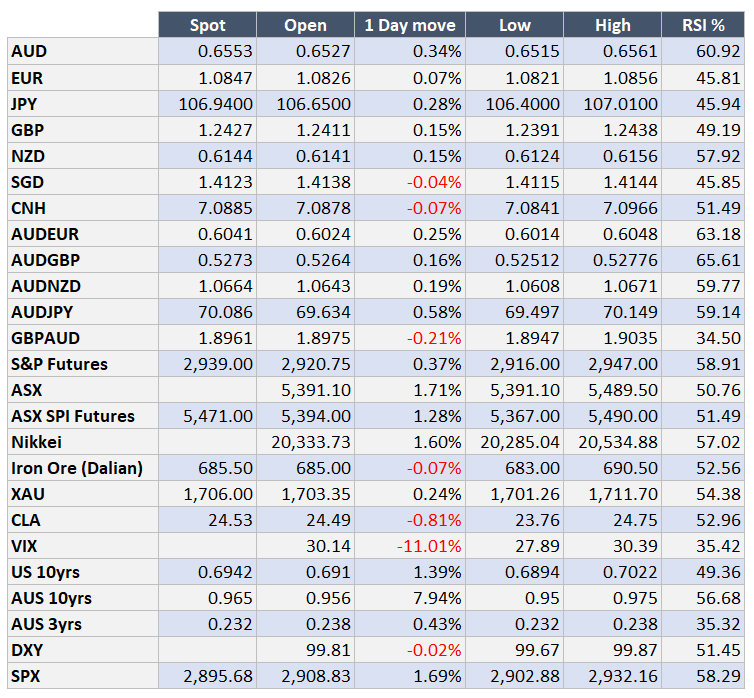

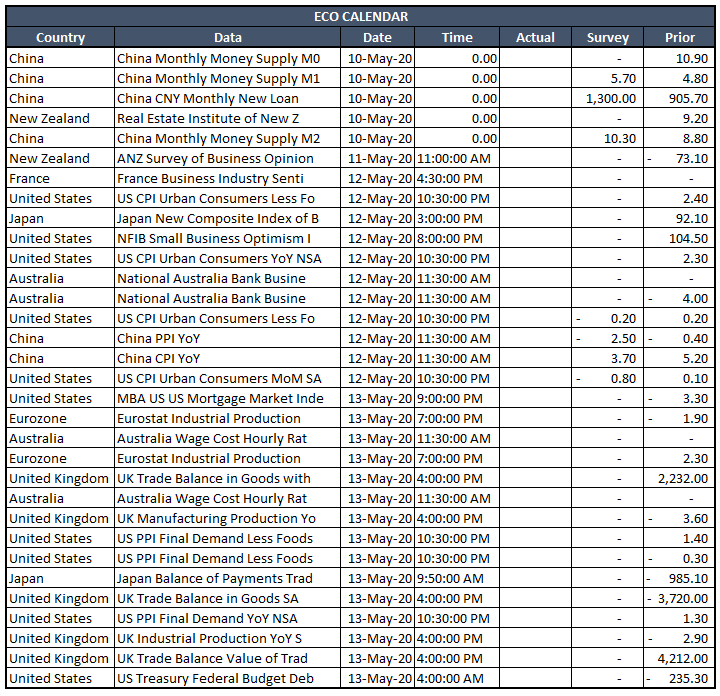

As the markets continue their buy the dip mentality, Central Banks continue their modest, glacial improvement assessment. More will be revealed on Wednesday night by the Fed’s Powell, but its expected he won’t delve into negative rates – helping US10’s back to 0.7% and held back risk currencies from initially moving higher as USD was bought.

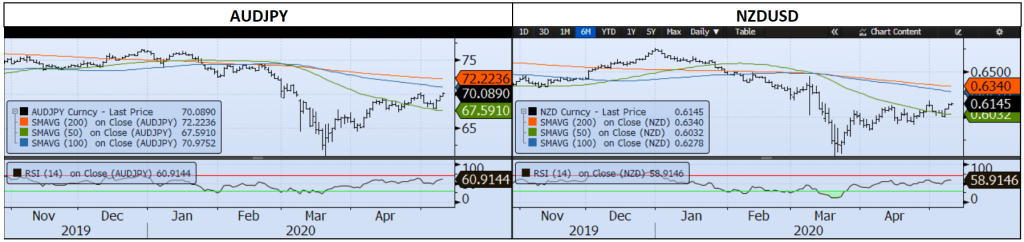

We are seeing a retest of April highs of 0.6570 for AUD and next stop 0.6673/85 alongside 2,964 in S&P (less than 1% away). It hasn’t been a dead-cat bounce by any stretch and this misalignment in Street views doesn’t have a particular timeframe where they meet in the middle.

Contact the Inside Track Research Team for more info: +61 2 8916 6115