Market Update: 6 July 2020

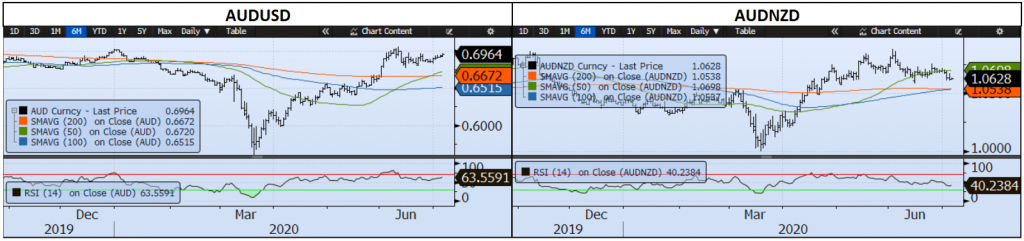

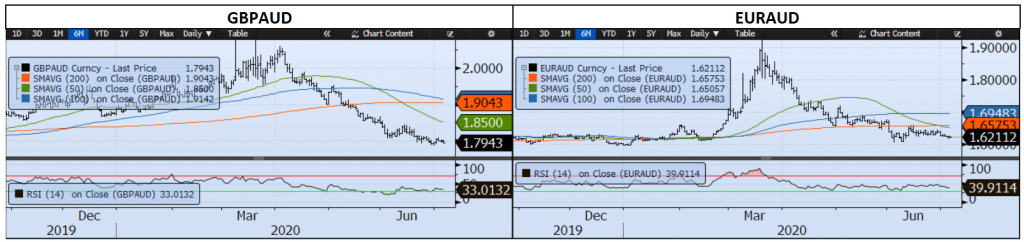

As the US celebrates a long weekend after US Payrolls gave markets a strong boost, the continued struggle between price action and COVID cases continues.

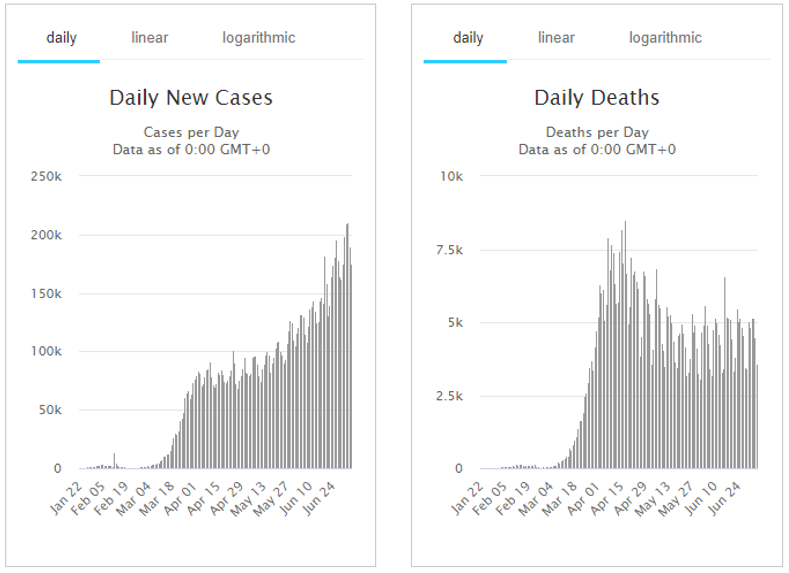

Globally, we have seen >200k cases per day – taking us up to 11.5m. What is interesting (and good) is daily deaths in comparison aren’t moving up at the same pace. What this of course means is that the Mortality Rate has dropped to 4.6%. Perhaps emboldening leaders to also think it’s less lethal, but still highly contagious.

But as we pore over the malaise of COVID 2nd wave and to now learn the NSW/Vic border is closing on Wednesday, somehow, sentiment remains elevated. It’s very true that data has outperformed market surveys – but 12% unemployment isn’t exactly a win (unless you’re comparing against a 13% survey).

So besides 4th July, what else should be celebrated? Well if this is the 2nd wave, it’s not necessarily as fearful as the 1st. Yes, there’s shutdowns, but they’re not across all states. The strong belief of a vaccine by year-end or Q1 remains as the central case and furthermore, in most part – we are acclimatising to our new normal. It is not a new unknown, but the re-emergence of something in which we have a strategy to combat.

In a way, data (especially that of sentiment) is then reflected in new data and as people see it translated into market rallies, it again improves the next set of data.

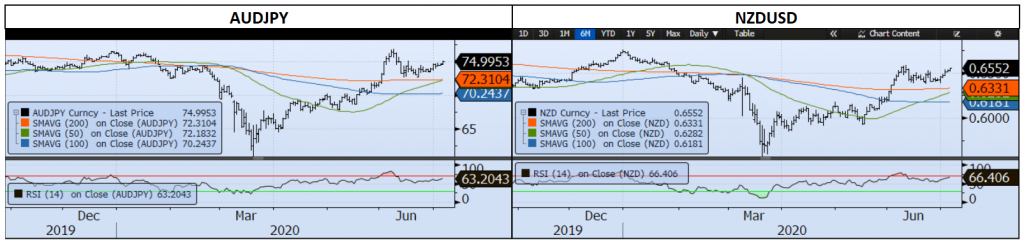

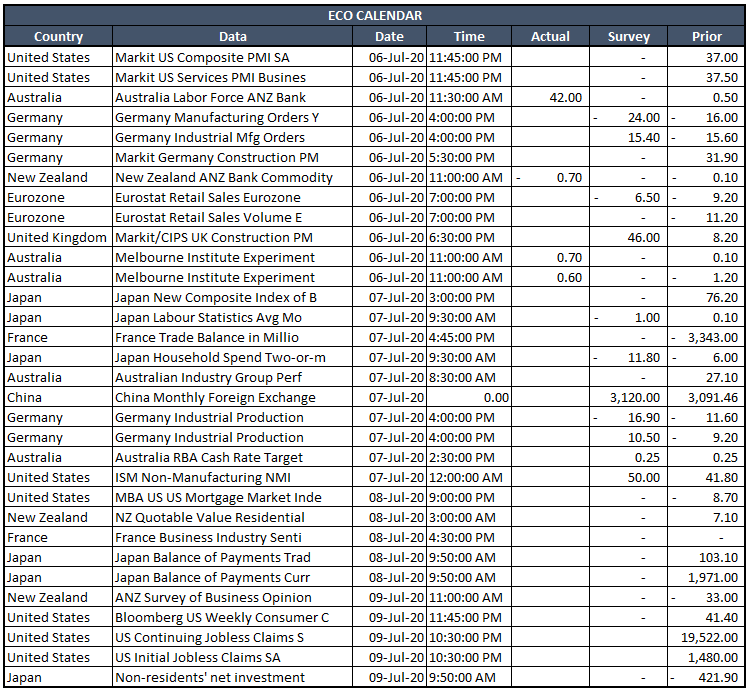

The week ahead brings RBA – who will make mention of Victoria, but won’t panic. China CPI and US Jobless claims.

Contact the Inside Track Research Team for more info: +61 2 8916 6115