If you are still worn out from implementing MiFID II and figuring out whether your firm would be subject to daily margins in FX derivatives, you are not alone. But I’m afraid there’s more to come.

From June 2021, certain European MiFID firms that are currently subject to prudential requirements set out in the Capital Requirements Regulation (CRD IV) and Capital Regulations Requirements (CRR) will transition into a new, more focused framework: the Investment Firms Regulation (IFR) and Investment Firms Directive (IFD).

Although the new prudential rules have implications in various areas including remuneration requirements for investment firms, we will focus today on the new capital requirements.

Why is this relevant to my firm?

In a nutshell, this is very relevant because many investment firms will be subject to higher regulatory capital requirements (to be implemented over a transitional period) and a new set of complex monitoring and reporting obligations.

One important clarification: throughout this document, when talking about investment firms I mean MiFID investment firms (this classification excludes AIFMs and UCITS). There are, however, some implications for AIFMs and UCITS which I’ll discuss below.

Is my firm subject to the new rules?

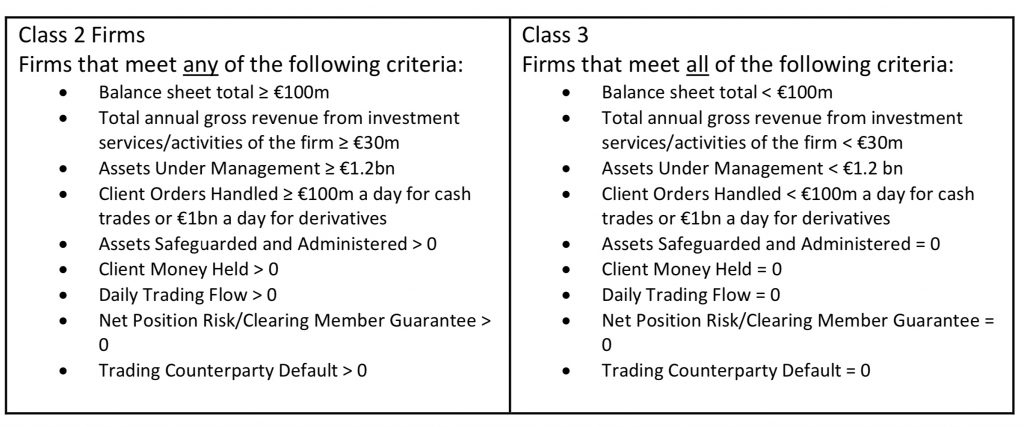

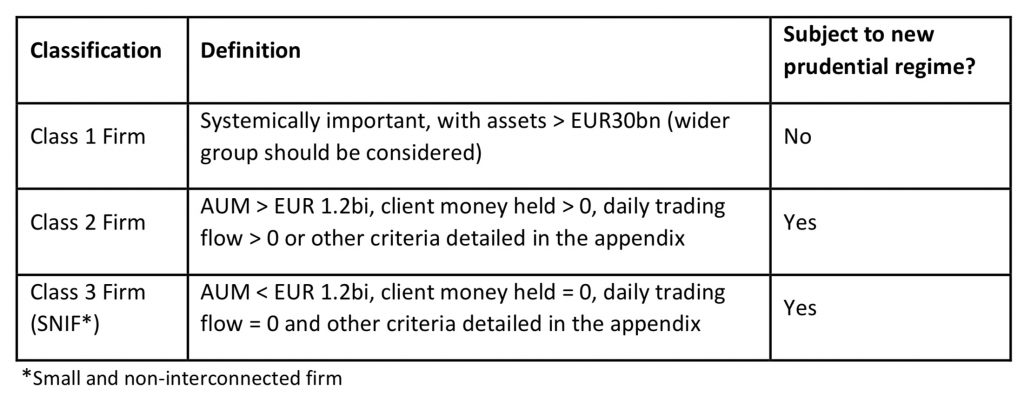

The new prudential regulations apply to Class 2 and Class 3 firms. This is a new classification framework introduced by IFR which I’ll summarise below:

For the purposes of this article, I’ll focus on Class 2 and 3 firms.

My firm is classified as Class 2 or 3. What are the implications?

The first implication is that the classification criteria described above will have to be constantly monitored in order to apply the correct capital requirements calculation.

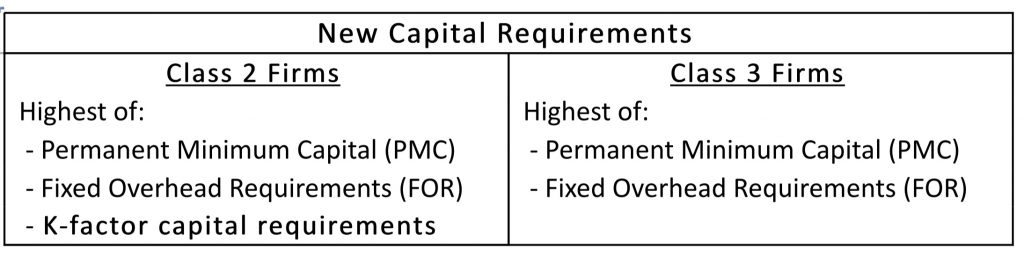

The second (and main) implication is that firms’ own funds requirements will be based on the following criteria:

The Permanent Minimum Capital (PMC) required for authorisation for most firms will now be set at €75,000, €150,000 and €750,000 depending on the investment activities the firm carries out. Firms will have to hold this minimum sum on an ongoing basis.

In many cases, for Class 2 firms, it is likely that the Fixed Overhead Requirements (one quarter of the investment firm’s fixed overheads for the preceding year) will surpass the other items and therefore set the required regulatory capital. It is paramount, however, to make sure proper monitoring systems are in place.

For our brief deep-dive into the equation, I’ll solely focus on the K-factor capital requirements for Class 2 firms as this is the most complex calculation and where our clients will likely need more help with.

Note that Class 3 firms, although not subject to the K-factor requirement calculation, will still need to monitor all the criteria related to their classification and be prepared to change their approach in case a Class 2 classification is triggered.

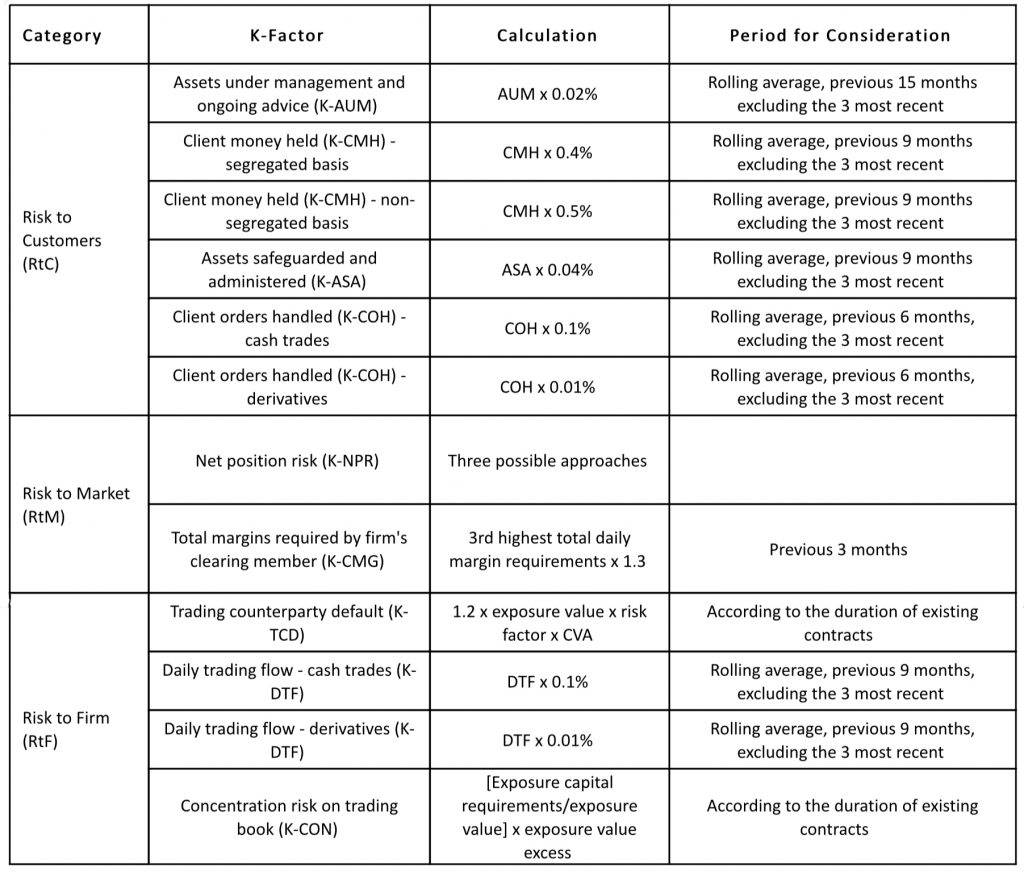

K-factor capital requirements

K-factor capital requirements will be based on the following factors:

For the enthusiasts, the calculation is broken down below (if you’re tired already, just skip everything else and go to the ‘How we can help’ section!):

What about the UK?

The new framework only applies to EU member states. Brexit, therefore, has created uncertainty as to whether the UK will be required to comply. The FCA has published a discussion paper on 23 June 2020 indicating a broad alignment with the IFR/IFD framework for the UK. The discussion paper, however, does not necessarily reflect the final position from the FCA – we will keep you updated on any further developments.

What are the implications for AIFMs and UCITS?

The IFD regime will make amendments to the existing AIFM and UCITS Directives, which means AIFM and UCITS firms will be required to have own funds above the Fixed Overhead Requirement level (one quarter of the investment firm’s fixed overheads for the preceding year).

What should I do next?

- First of all, speak to your legal counsel as soon as possible to understand to what extent the new rules apply to your firm – there’s less than a year to go!;

- If your firm is subject to the new requirements, you should start making an inventory of all the required data for the relevant period (15 to 6 months’ worth of data, depending on the factor) and establishing processes to collect and report this data on a regular basis (at least quarterly);

- Start planning for the (likely) increase in the mandatory capital requirements and understand its implications for your firm, keeping in mind there will be a transition period before this is enforced.

How can we help?

- Rochford can work with you to establish an automated reporting and monitoring process, effectively allowing your firm to outsource these complex and extremely time-consuming requirements:

>> We will support you during the planning stages, creating data inventories and the process flow to make sure these are regularly updated, creating the mandatory reports and simulating your future capital requirements;

>> After the new regulation has been implemented, we will efficiently produce the mandatory reports using automated data feeds (to the extent a systematic feed is available from the client side) and alert your firm to any changes in your classification and capital requirements on an ongoing basis - As part of our Currency Overlay solution, we dynamically manage the liquidity implications of any hedging strategies and how this interacts with the liquidity of the underlying investments and regulatory demands. As derivatives may probably increase the capital requirements for firms after the new rules are implemented, this dynamism will be even more important.

Are there other implications related to the new IFR/IFD framework? Are there any exceptions?

Yes. These are beyond the scope of this article, but I do recommend reading an in-depth memo such as this one from law firm TraversSmith: New EU Prudential Regime for Investment Firms.

Would you like to know more about how we can help your firm navigate these changes? Please get in touch with our team:

Email: ukenquiries@rochford-group.com

Phone: +44 208 057 9180

To subscribe to our bi-weekly updates for fund managers on treasury and financial risk management, please complete the subscribe form.

Appendix

Class 2 and Class 3 classication criteria.