Market Update: 9 April 2020

If I were to tell you I’ll take 1/3rd of your money but give you 1/2 back because your job is at risk whilst I confine you, which would you say was in haste? Fact as usual, proving stranger than fiction.

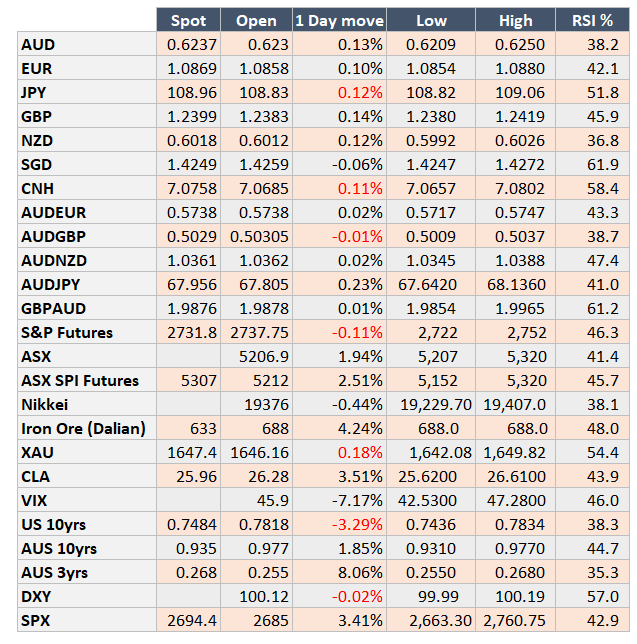

We’ve seen S&P rally again last night 3% on talk of additional stimulus package by Trump as well as Russia being paid to work less (i.e. cut Oil output). This nearly takes back half the losses of S&P since 20th Feb as the markets see the flattening of the curve.

I am loathe to talk technicals in a Macro environment, but it definitely has its place when things become “normal”. In this context, 4.5% higher for S&P should be major resistance and marks the top of the inverted head and shoulders formation.

The same can be said about AUD to an extent… trend resistance is closer to 64c should we consider 70c the starting point.

The fortunes of ASX aren’t as similar, it’s still 24% lower from February.. in fact, had you been long S&P in AUD terms unhedged, you’d be down 13% now, or better yet, had you been long S&P, then fully hedged AUD at 0.5510 you’d actually be flat.

It’s reasons like this why options make sense. Although vol pushes the premiums higher, I don’t expect everyone expected this overreaction to be matched by another.

As we stay indoors over this break, wishing you and your families a safe time (and perhaps hide the remote).

Source: Bloomberg

Contact the Inside Track Research Team for more info: +61 2 8916 6115