Market Update: 29 June 2020

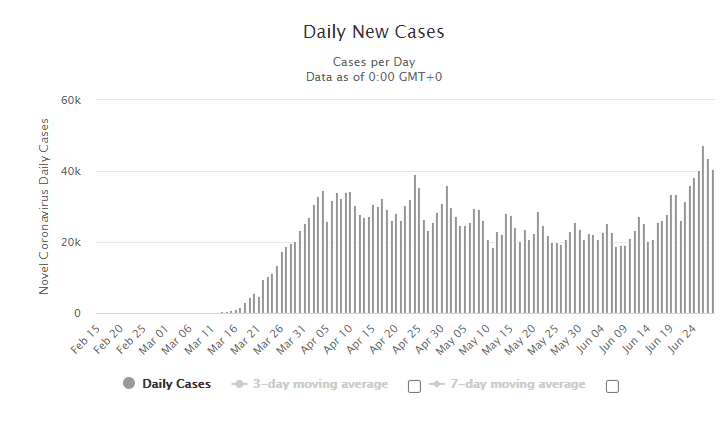

The “recent” past is coming back and certainly reminding us that this pandemic is not over, nor eradicated. In what was certainly a surreal situation of being home and practicing social distancing for a period of time could just as easily be back on the table should we experience what seems to be our version of a 2nd wave.

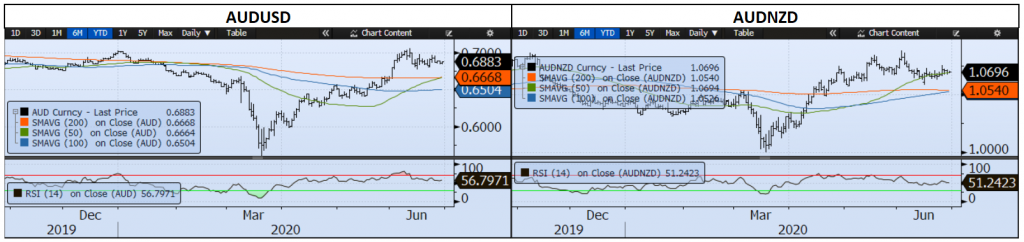

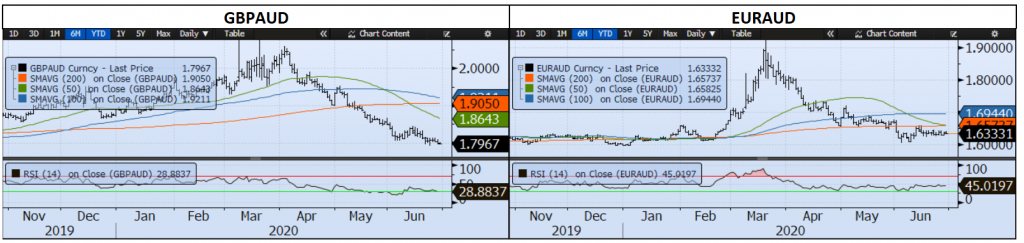

No health authority seems to be categorising it as 2nd wave for now as perhaps there’s a semblance of control in comparison to the early weeks of shocking numbers rising, but we again experience rising (not falling) cases in both Australia, US, South Korea and parts of Europe. Again, plain numbers increasing is outpacing previous highs vs the percentages game but this time, the markets are reacting negatively. We are seeing S&P falter to 3,000 and certainly at risk of testing June 15 lows, AUD is a similar pattern to an extent – although more akin to a holding pattern that could break up or down quite easily.

So as we now hit over 10mil cases globally, over 500k deaths and only a 52.2pct rate of recovery so far (although more seem to be stopping the report of recovery like UK, Netherlands, Sweden and Spain), it’s not compelling enough to believe the past has played out. On a total cases per capita, we see the Americas as the highest but on a deaths per capita it’s Europe. As for explanation, well some of it is due to levels of testing alongside with how recent COVID was contracted vs pressures on hospital system and demographics of population. The bottom line is that fact that we’re still talking about this is disheartening.

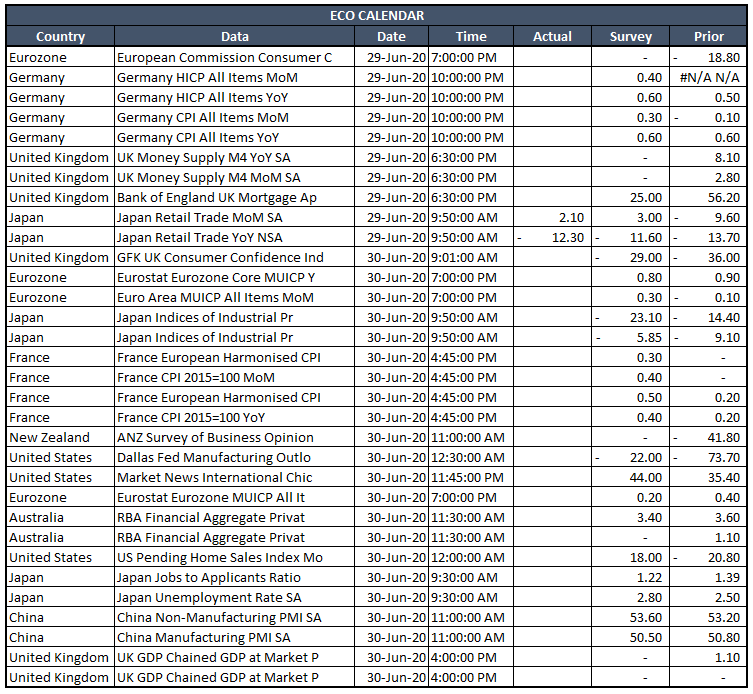

The week ahead sees some decent sentiment indicators like China PMI, German Retail Sales & unemployment, Australian building approvals, US Payrolls, ISM and Japanese Tankan.

Daily New Cases in the United States

Contact the Inside Track Research Team for more info: +61 2 8916 6115