Market Update: 24 June 2020

As European PMIs including UK came out better than expected and Germany has relaxed its warnings on ECB stimulus, markets continued on its positive tone. It’s not an all out buy everything with your ears pinned back mantra, but it’s enough fuel to start testing towards recent highs.

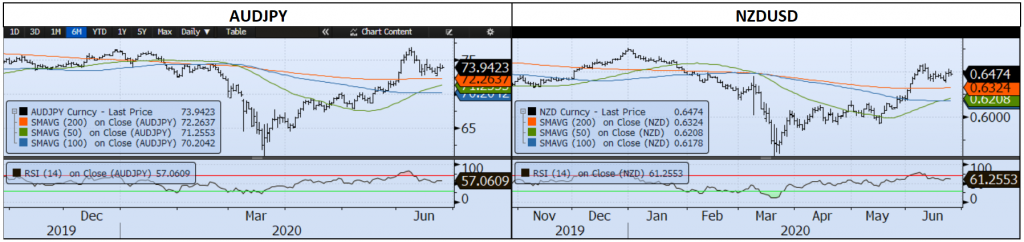

What we essentially have now is a market that’s happy given trillions of stimulus globally, PMIs are starting to get the hint that consumption will resume and yet Central Banks RBA and today RBNZ just aren’t as convinced. They have maintained a fairly bearish tone, acknowledging some light at the end of the tunnel and perhaps there’s a need for the CBs to meet somewhere in the middle with market enthusiasm.

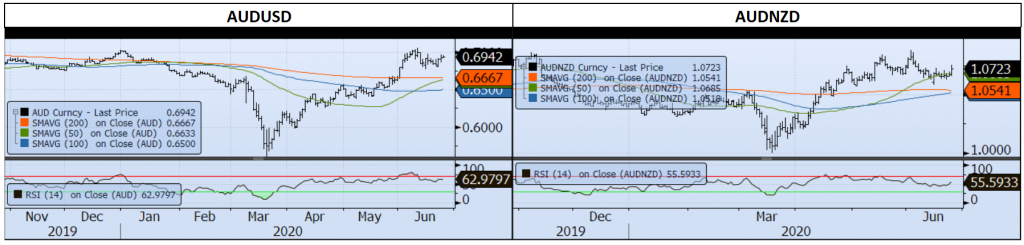

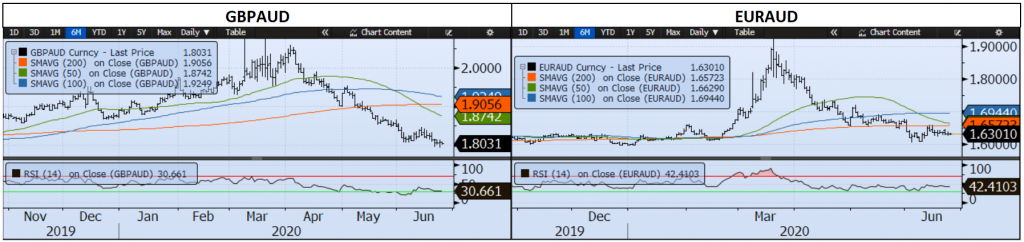

Perhaps it’s more to do with the one thing they really want lower – their currency. The way to be more competitive, the way to import inflation, the way to avoid cutting rates into negative territory is indeed a lower currency. RBA were ok with current levels but preferred AUD lower, RBNZ noted the recent appreciation puts pressure on export earnings. Again, we are reliant on our export partners to reinvigorate both economies. Given tourism is out of the question for the foreseeable future, university students on hold, it would seem the only thing to soften the blow is commodity exports (priced in USD).

We do as always have downside risks to consider, California COVID cases rose alongside a German region lockdown and a few tennis players on the way. The war of words between China and pretty much everyone else continues, but flush with stimulus, it confirms falls are short-lived and AUD is still within its upward trend to test higher.

Contact the Inside Track Research Team for more info: +61 2 8916 6115