Market Update: 14 September 2020

Although we haven’t gotten anywhere with Brexit and the US election is a coin toss, the one glimmer of hope is the restart of the Phase 3 Astra-Zeneca trials.

This in itself isn’t a silver bullet, but it has reversed some of the last week’s stock selloff with S&P futures +1.2% today. It would be fair to say that Nasdaq after falling over 12% from peak should be also due for some bounce. Especially given there’s not much else going on data wise today.

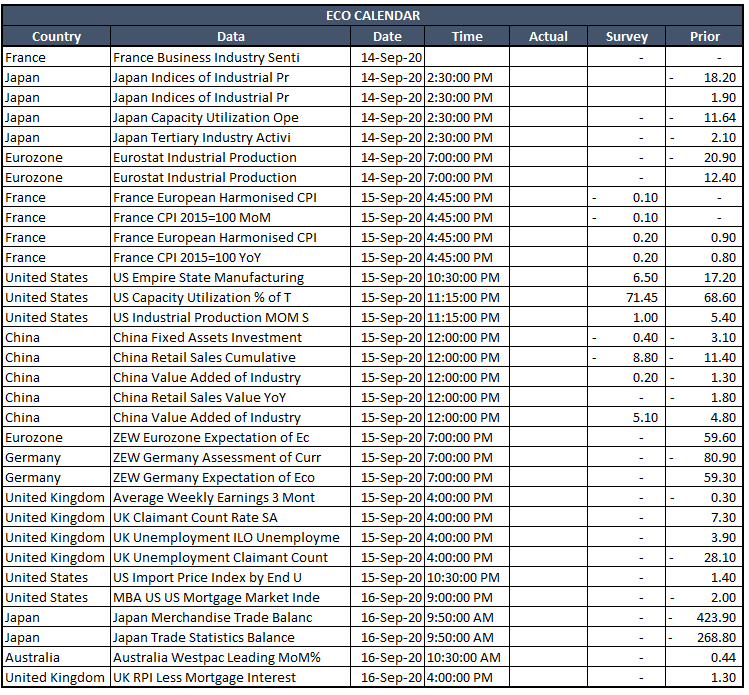

The rest of the week is a different matter as we locally have RBA minutes and Unemployment, but we also see China Retail Sales and Fixed Asset Investment, BOJ policy meeting and the big FOMC meeting.

The FOMC have in part, disappointed without much intervention in the bond space but as they seek to become more transparent, perhaps this will reveal a bit more of their longer term plans. Nonetheless, quite a few have already been burnt on expecting a curve play, so it could just as easily lead to some greater volatility should they make mention of the longer dated bonds.

From here, it does feel like a bit of sink or swim for tech stocks… they’re at some strong supporting levels, nearly oversold and perhaps will dictate sentiment in the next few weeks. If it gets its chance to being again, it may indeed just stay within its upward trend.

Have a great week ahead!

AFAMA update (Apple, Facebook, Alphabet, Microsoft, Amazon)

Contact the Inside Track Research Team for more info: +61 2 8916 6115