Market Update 31 March 2020

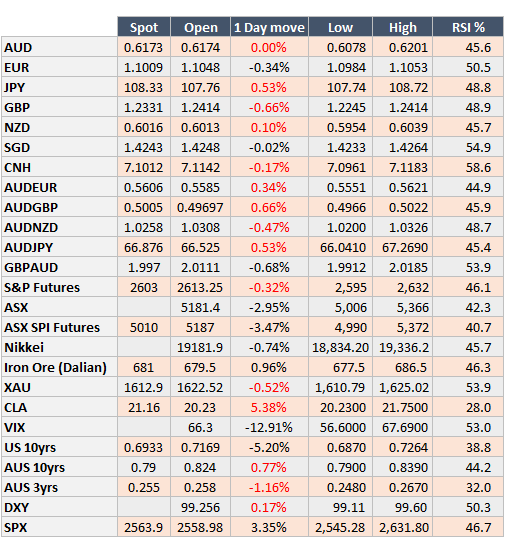

As the Australian Government announce ways for businesses to go ‘into hibernation’, their package to support workers appeased the ASX immensely but didn’t translate into a true AUD move.

AUD/USD has been hostage more to USD moves as we enter quarter-end, and initially, a free-fall to 0.6070 was short-lived at the Tokyo fix – which reminds us of the market fragility. After that, a move to 0.6201 ensued as China PMI came out a massive 52 vs market expectations of 48 was very supportive.

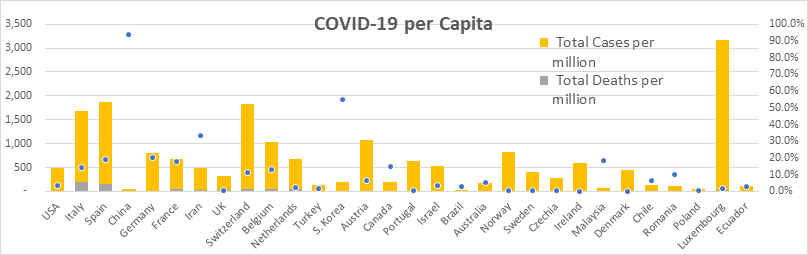

So, China feels like we’re back to normal versus markets pricing in a recession. We would still back the latter with 65,000 cases added in 1 day alone and supply chains closing up in Europe. The trajectory of cases aside, how long it takes to reopen for business is now a crucial factor.

Having said that, Australia, for now, has a more enviable position of a low mortality rate, but the recovery rate is too low to call this any form of victory – it is still well placed for a rebound when it comes. This is why we’re more constructive in the medium to long term for AUD/USD.

The graphs below shows perspective. The US might have the highest cases of COVID-19, but per capita, it’s not the worst.

Are we peaking globally? The US isn’t..

Contact the Inside Track Research Team for more info: +61 2 8916 6115