Market Update: 9 July 2020

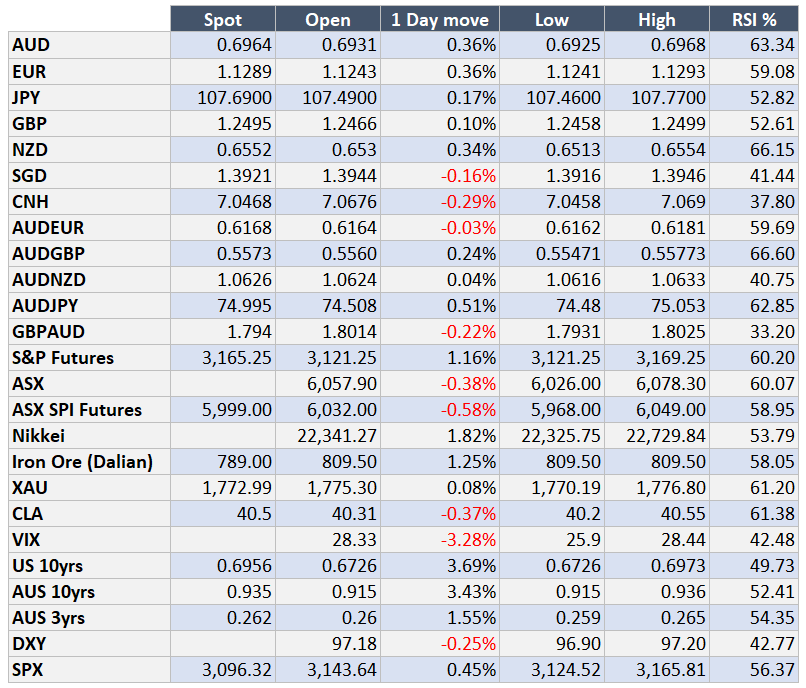

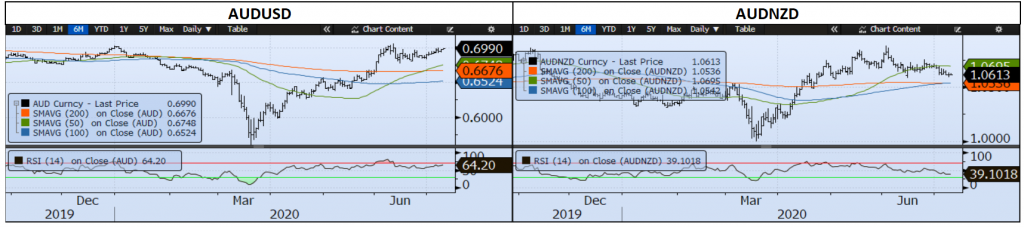

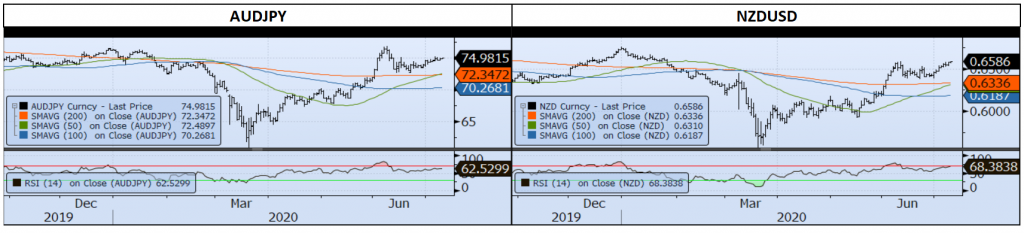

As the weeks go by, we’ve seen S&P rally, fall, then rally again. It’s not necessarily directionless – it’s more reacting to the macro-fundamental themes at play. How this translates for AUD though is a very narrow move all stuck within 0.69. The range it’s trading at is forming a rising wedge pattern. Unless it can comprehensively break 70c, it is at risk of testing down to 66c.

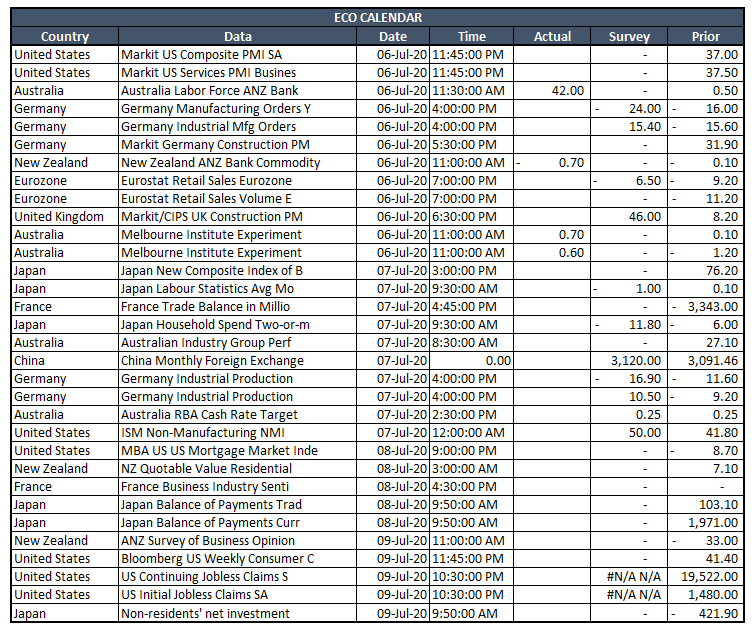

Besides now being above 3million cases and 2% daily increase in the US, other drivers to counter the risks are a less concerned Fed… Bullard believed Unemployment by year end could be below 7% alongside Chinese Stocks making new highs above 2019 levels. Other themes such as Northern Hemisphere holidays also play a part in why AUD is just unable to break the range.

So as Victoria goes into lockdown, RBA acknowledges it in the Tuesday meeting and maintains a positive story that the worst is indeed behind us – which hopefully is the case, but they in the same breath expect a large degree of uncertainty to come and thus continue their pledge to hold lower for longer.

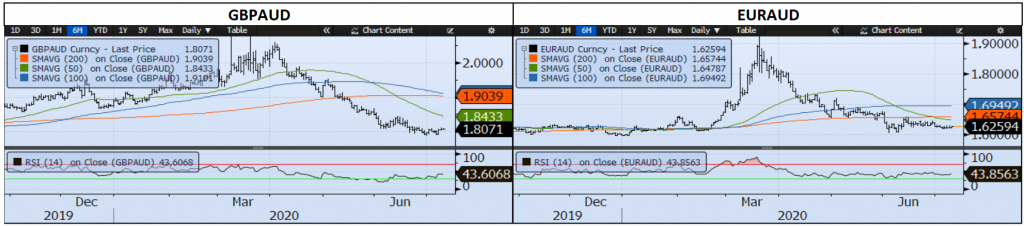

On the UK front, GBP (alongside EUR) have been well bid as trade negotiations are seen in a positive light, alongside the Chancellor of the Exchequer looking to unveil further stimulus package to keep furloughed staff employed. Having said that, GBPAUD is only minorly higher as USD gets sold across the board.

Contact the Inside Track Research Team for more info: +61 2 8916 6115