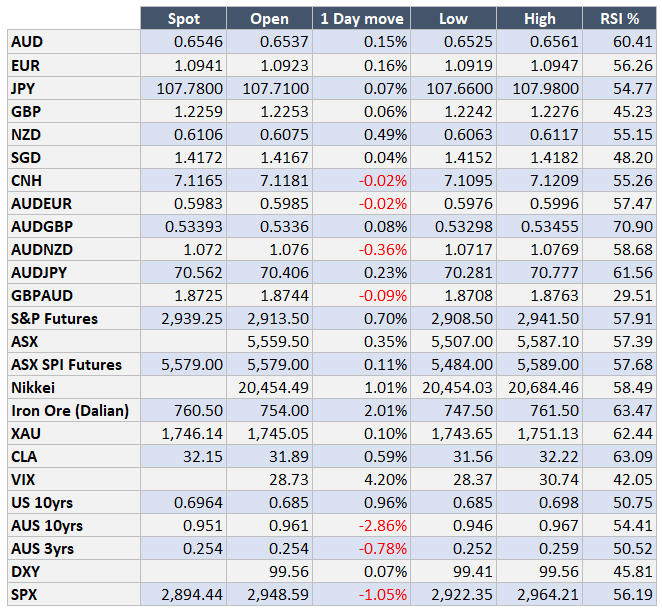

Market Update: 20 May 2020

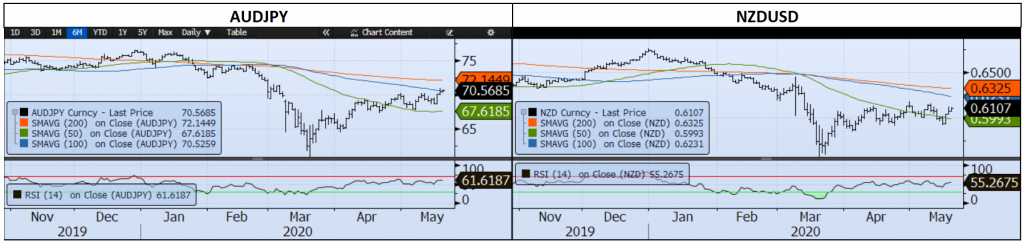

An interesting start to the week as China gives into the World Health Authority by agreeing on an investigation (after the pandemic), but then goes in for the jugular against Australia in Barley, Beef and now potentially Wine, Dairy and Coal. So what does AUD do, being pretty much singled out and seeing it’s largest export market at risk? It rallies of course. Why? There doesn’t seem to be any trade at the moment as highly correlated as AUD to S&P – see below.

It seems AUD doesn’t want to leave the side of S&P, despite not outperforming, with Australia’s better than most of the world pandemic handling (perhaps not in diplomacy according to China), but all its negatives being this trade dispute. Recall China was the country that stopped Australia from going into recession in 2008/09. It of course isn’t the reason to stop asking what happened in Wuhan, but this is a big stakes game for a small population.

So why is the correlation so high? Traditionally AUD has had positive correlation to S&P – the last 5yrs average is 0.32, but the past month is more like 0.6 – verging near 0.8 at times. This is either a trading strategy in itself – S&P is up, then Buy AUD and no-one else has enough money to participate after expecting AUD to break below 55c or the markets don’t see these trade restrictions as either detrimental to cross-border flow or they believe it’s transitory. Whatever the case, should this trend continue, we could soon be testing above 66c and perhaps towards 70c sooner than we envisaged until as with all trade anomalies, they fall apart.

Keep an eye out for the China National Party Congress on Friday to understand if their vision involves infrastructure and more importantly, Iron Ore.

Reference:

AUD can’t leave the side of S&P….

Contact the Inside Track Research Team for more info: +61 2 8916 6115