Market Update: 4 August 2020

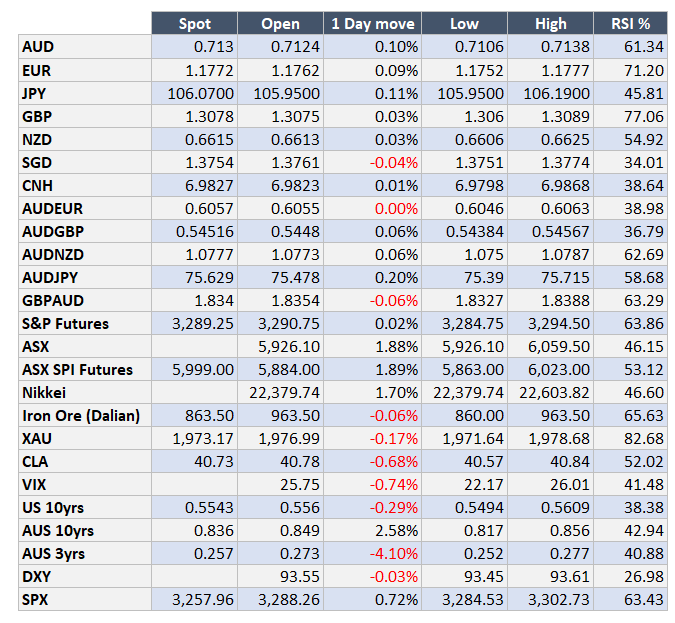

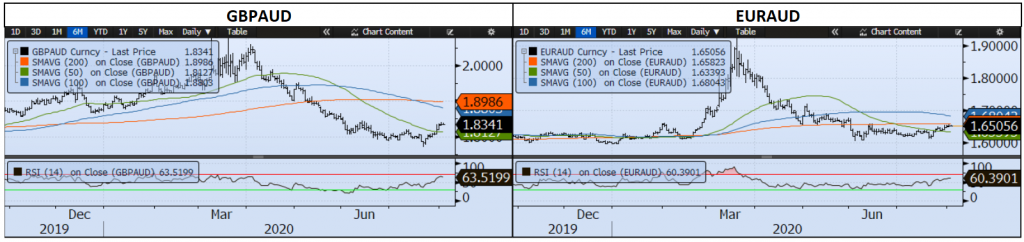

As ISM in the US comes out far better than expected at 54.2, US stocks continue to make new highs. The correlation for AUD to S&P though has broken down again as we attribute a relative value case between the US and Europe – in other words, AUDUSD is more a USD move. GBP also lost some ground on USD and GBPAUD drifted lower.

After a bank holiday in NSW, the digestion of Victorian lockdown measures had originally hit ASX, but ended flat, to then go for catch up mode against its global counterparts – but still AUD has been minorly supported.

With the Victorian closures, we saw a testing of the trend channel down to 0.7077 and a small correction since. I don’t necessarily think this is end-game for testing of the trend, but in a high stimulus game, it comes back down to invest or miss out given cash rates.

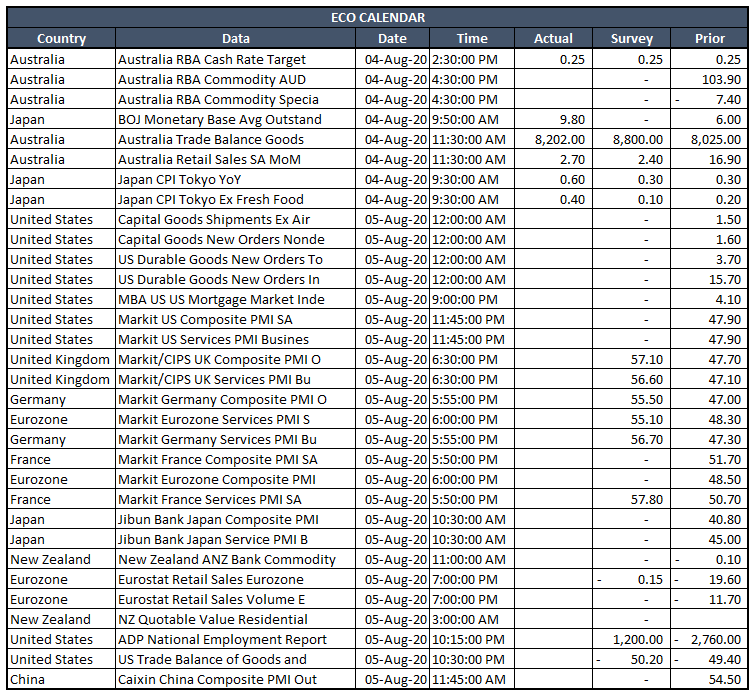

With retail sales worse today and RBA revealing in their statement their wide-ranged scenarios of stress-testing, it’s fair to say, not much will occur. They supported the 3yr bonds by announcing some purchases given it had moved slightly away from their 0.25% target. There was also acknowledgement of the Fiscal programs implemented/extended to support the economy – so another reason to sit on their hands. It did sound sobering to hear 7%+ unemployment will persist for some years.

Post worse US GDP last week, we have Payrolls to consider on Friday – it won’t be rosy given Jobless claims have disappointed since, a 10.5% unemployment from 11.1% might even sound optimistic.

Have a great week ahead!

Contact the Inside Track Research Team for more info: +61 2 8916 6115