Market Update: 17 August 2020

As we near elections in the US, the markets start considering a world with a Democratic win – given Betfair has Biden at $1.70 vs Trump $2.44 and of course these odds and polls are always right… right? Given though Hilary Clinton has shorter odds than Mike Pence despite Kamala Harris being nominated for VP, it’s fair to say we’ll bet on anything that moves.

Now that NZ PM Ardern just delayed their election by 4 weeks to October 17 due to COVID concerns and Daniel Andrews extends lockdown in Victoria to 4 weeks, maybe we should be making a market in November 3 being the election date or not. Trump had already sounded that out and got a firm “no” by both sides of politics and he’s not interested in Postal Votes, but it’s plausible 11 weeks away we won’t know the next President.

What would that do to markets? Well, no news is good news in a way… think about housing prices that have not fallen as disastrously as the doomsayers would have you think. Why is that? well besides mortgage rates having a 2% handle, banks are continuing to push out their requirement for mortgage repayments. So, if the piper is not asking to be paid, then we just continue on the trajectory with the trend being your friend.

There are still some important risks to monitor – US-China trade deal (that was also delayed), but relations have remained sour for the past few months alongside bans on Chinese companies and closed consulates, Approval for the next US stimulus alongside the Fed taking its foot off the stimulus accelerator etc… but for now, we just remain in the sweet spot for risk to rally.

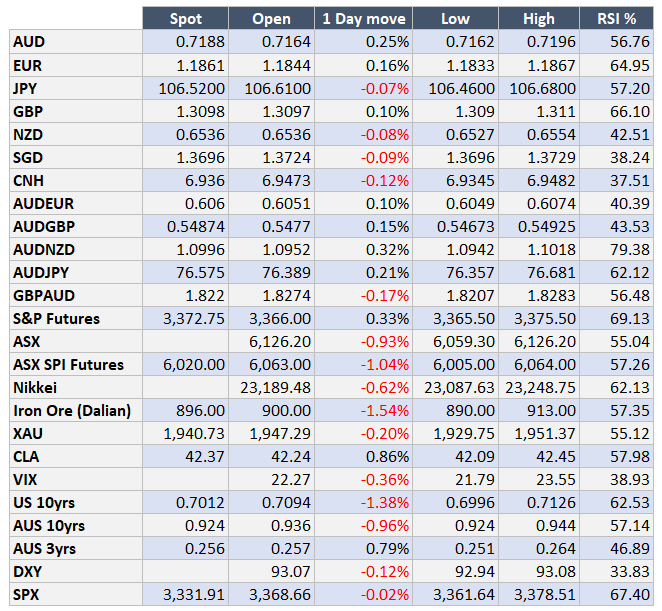

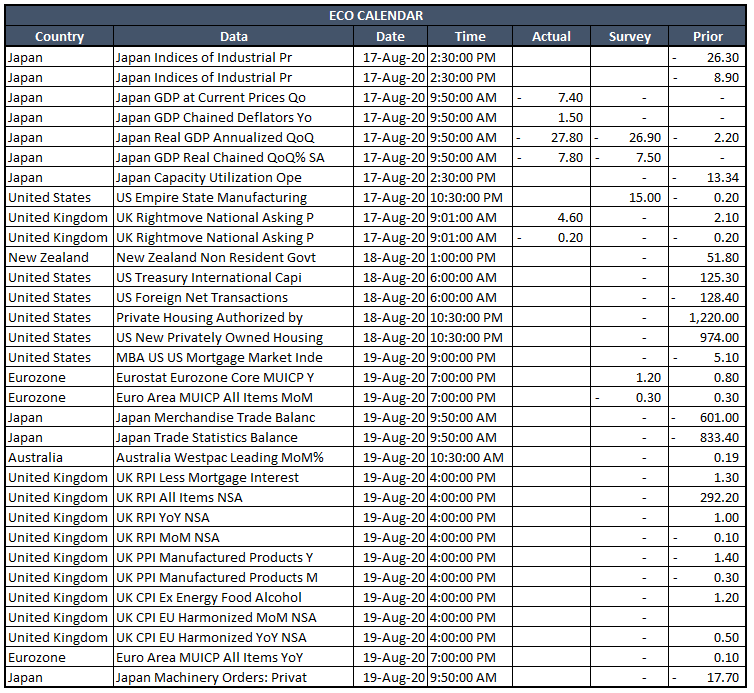

The week ahead see RBA minutes, Fed minutes, UK CPI, and of course the weekly US jobless claims.

Contact the Inside Track Research Team for more info: +61 2 8916 6115