Market Update: 28 April 2020

As Westpac follows NAB today in taking a $2.2Bln impairment charge, ASX takes a dip by 0.75% despite S&P +1.5% overnight. Should this be the canary in the coal mine or simply a statement of fact of the past?

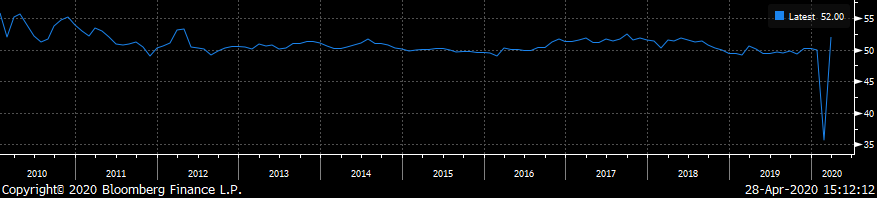

It does come as data such as Oz CPI for Q1 is announced tomorrow, yet most – including the RBA shouldn’t care as it’s not reflective of today nor the future. There are of course helpful metrics to consider like China PMI on Thursday for April – which can either reinforce their solid turnaround from 35.7 to 52.0 or prove transitory whilst the rest of the world followed and subsequently shut down from COVID. It could also assist in figuring out how much more stimulus China may have to provide and thus, can Australia again prosper as we did in the great commodity boom post GFC.

So how much of a grain of salt we can take on Q1 or Q2 metrics? Well perhaps GDP is not going to give much away for optimism, but Unemployment, Retail Spending and both Business and Consumer confidence will at least be a better guide for tracking recovery and if therefore markets are correctly priced.

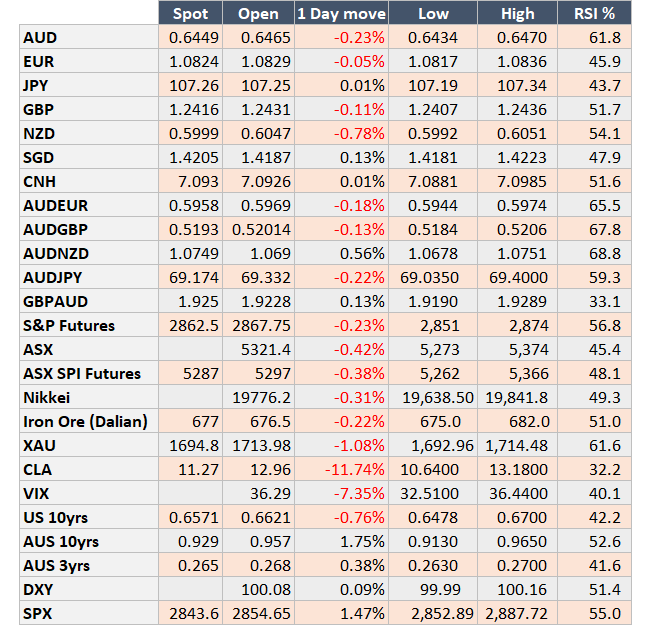

As with everything, it’s not always a straight line to success.. AUD gave away gains from 0.6472, S&P futs -0.6% and Oil back down 13% whilst Westpac sees RBNZ cutting to -0.5% later this year, putting pressure on NZD (taking AUD a small way with it).

China Manufacturing PMI

Contact the Inside Track Research Team for more info: +61 2 8916 6115