Market Update: 15 June 2020

Time for a breather, some consolidation and to take stock… or in this case, sell some. Markets have talked about a potential 2nd wave of reinfection and now it’s occurring. Whilst fortunately reinfection is not on a grand scale, we remind ourselves to go back to the data to assess.

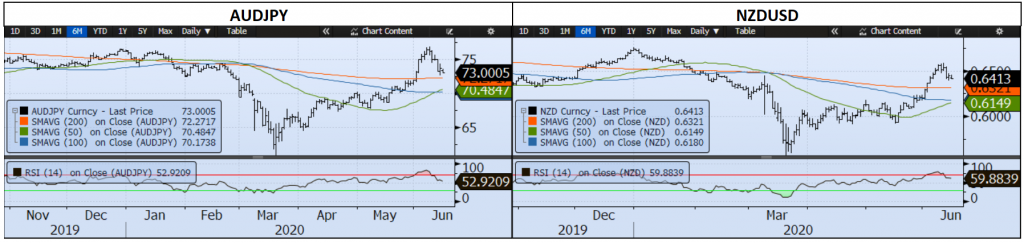

The markets tried to buy the dip from Thursday but so far have got their fingers burnt. Not to say they won’t try again during the remainder of the week, but it all comes back to COVID.

By the time you read this, we will be at 8million COVID cases worldwide where the US and Brazil have each added 100k since 4 days ago. Without making any political statement, statistically, areas where there are protests have not yet seen a big spike in cases* – but symptoms take up to 14days on average to show. It has been more the reopening of some states that has seen reinfection occurs – predominantly Texas and Arizona.

In comparison, China reported a new spike in cases over the weekend in Beijing – but it is a far lower number being 36 cases. The concern though remains high as China’s Vice Premier pointed out it’s related to a wholesale market in a densely populated region. In turn, there’s already lock downs occurring.

So it will come down to how swift actions are taken by authorities and to what extent of shutting down businesses occurs to regain an understanding of how economies will grow.

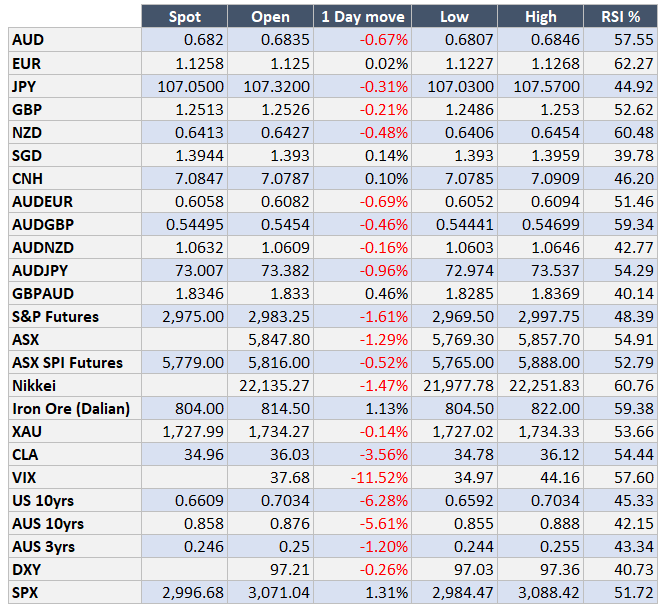

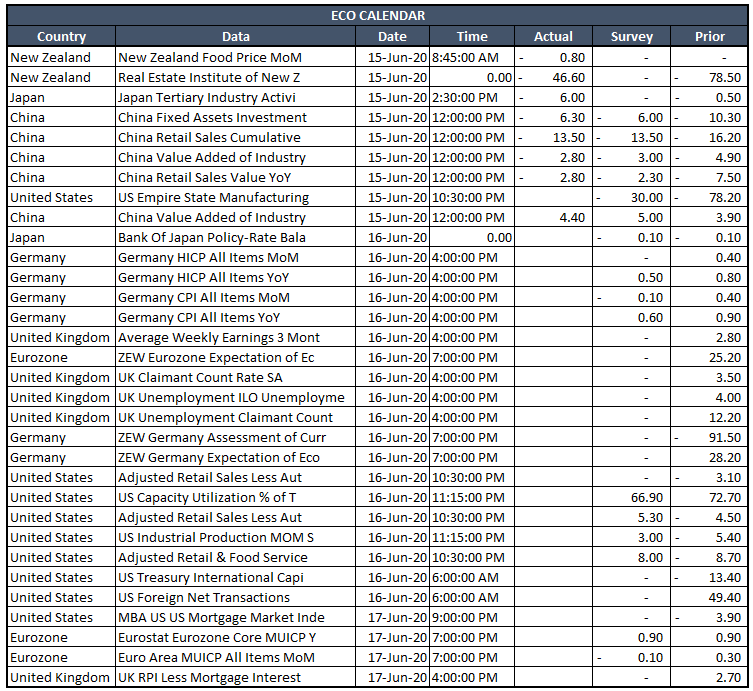

Data out in China though for May was a bit worse than expected for Industrial Production, Retail Sales and Fixed Assets. Locally, we have RBA minutes, House Price Index and a very important Unemployment Rate for May. Again unemployment will be skewed by participation rate, but it’ll be the change from April to watch out for rather than the headline number.

Contact the Inside Track Research Team for more info: +61 2 8916 6115