Market Update: 30 March 2020

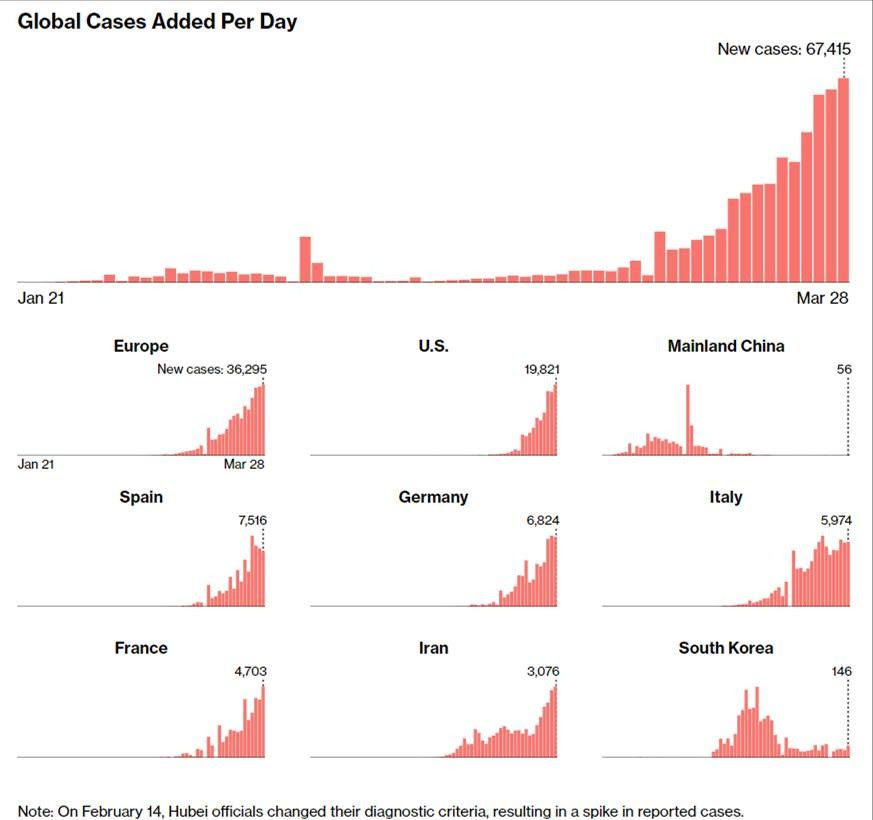

The upside of the weekend is that markets are not trading. The downside is, despite improvements on equities and AUD made during the week, the number of COVID cases continue to rise. This trend is set to continue for at least a few more weeks until we see a global peak in cases.

China, followed by South Korea and now Italy are showing that trend, but those still climbing (such as the US and Europe as a whole) are yet to give relief. For that reason, volatility is the one true certainty at present.

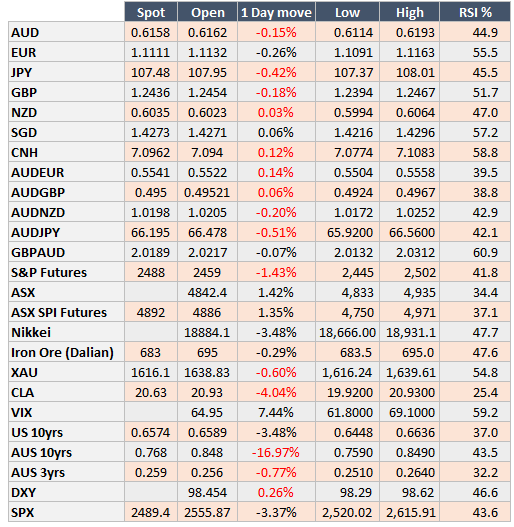

After a strong week of Equity performance, the bears came back as we started seeing a ramp-up in US cases. This, coupled with a lessened liquidity concern, pushed USD across the board lower and saw AUD touch 0.6200. This has again though been faded on Monday open to 0.6114. We believe, there is still some downside to occur – quarter-end tomorrow may certainly be the catalyst.

Key Themes

- Looking for the peak in COVID cases as the signal to buy risk

- The fallout of businesses and the cuts in jobs en-masse. What strain to both credit and the economy will ensue?

- The downgrades that are slowly coming in on both companies and country ratings

- Those countries that are going to suffer long term due to less action on social distancing/quarantine

- The countries that perhaps appropriately using both Fiscal and Monetary policy, but as we recover from COVID – which ones can afford it? Keep an eye on US 10yrs as an indicator of credit concerns.

Contact the Inside Track Research Team for more info: +61 2 8916 6115