Market Update: 18 September 2020

As we go past 30m COVID cases globally and sadly not far from hitting 1m deaths, the Central Banks are ever looking at ways to stimulate economies – but without doing far too much. It is very much a ‘touch and feel’ landscape. So all they can do is commit to lower for longer rates and see where that takes them.

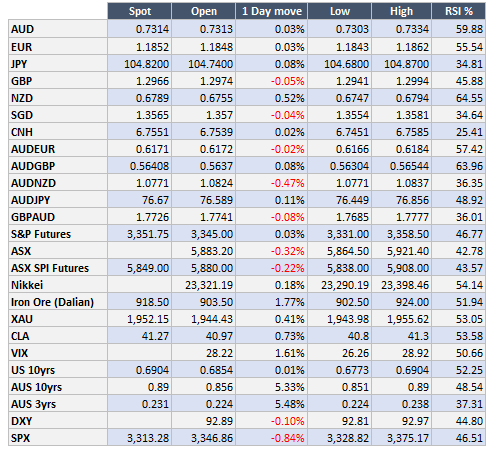

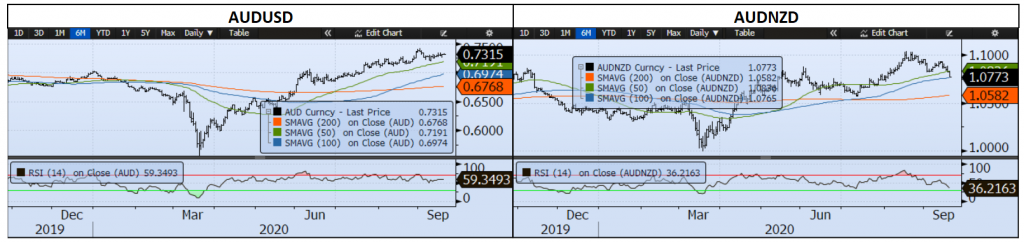

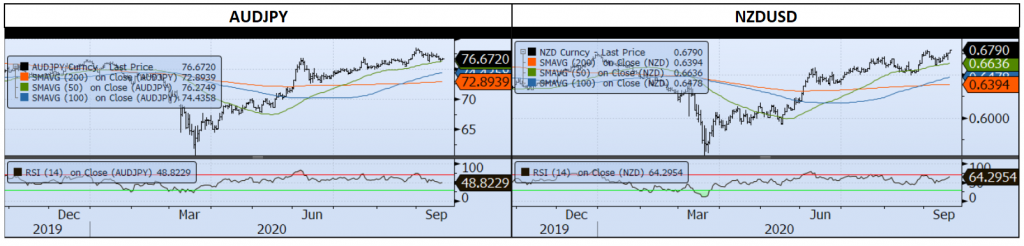

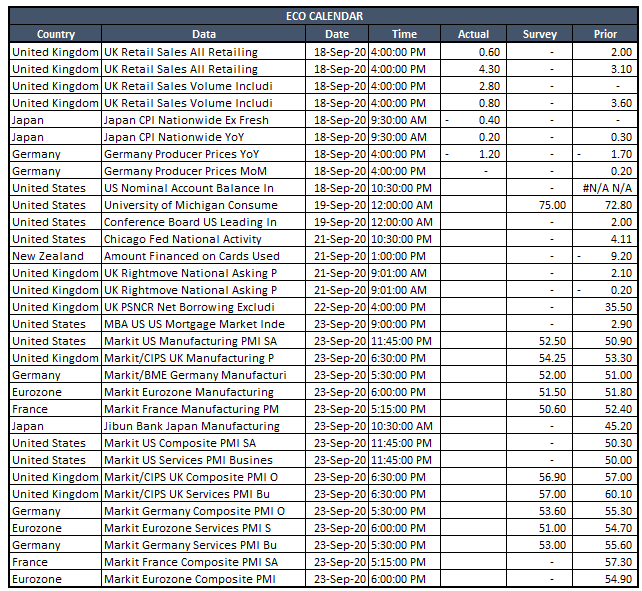

This week, we saw RBA Minutes do just that and didn’t mention FX levels – so AUD was supported. FOMC came out with a 3yr unchanged rate stance, but it didn’t resonate as the market wanted more. BOE Minutes, although without votes against to stay the course, did again bring up negative rates and may, alike RBNZ start getting participants ready for it to occur. That is not to say they will, but it’s more a luxury of telling the market what’s in their toolbox if needed. Somewhat of a sentiment boost by words alone.

The RBNZ could certainly enjoy a continuation of those words given their GDP fell by 12%.

Data as a whole, was mostly ok. Australia saw a far better unemployment number – lower by 1% than some market expectations at 6.8% with 111k jobs found vs -35k expected… but it wasn’t enough. Jobless Claims continued to fall – a little bit worse than expectations… but it wasn’t enough. Even some concessions on Brexit and EU commitment to find a deal wasn’t enough… enough for what?? stocks.

They’ve stumbled a bit this week and although it’s fair to say pricing perfection can only last so long. Again it’s tech led and nothing seems to be making anyone happy not even with Apple releases. Maybe this is the inflection point when things go flat to down until we’re convinced by better data?

Have a great weekend (Shana Tova)

Contact the Inside Track Research Team for more info: +61 2 8916 6115