Market Update: 17 July 2020

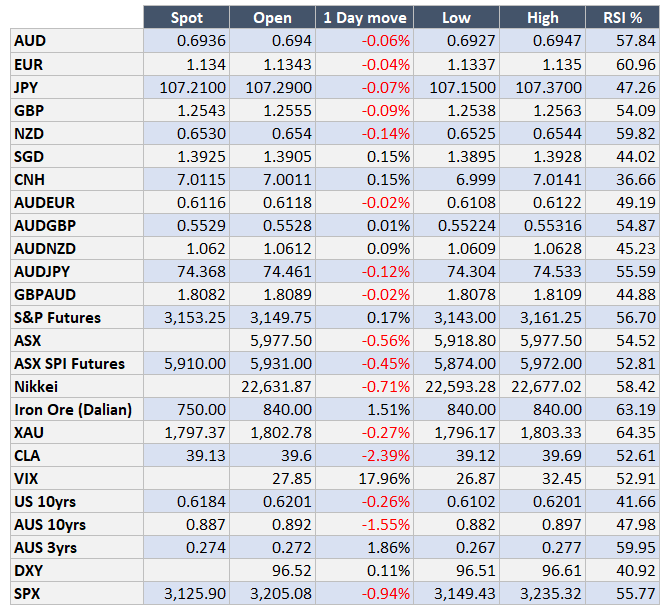

As AUD fumbles back at 0.6985, it’s evident there’s growing concern with international influences that hold back a rally.

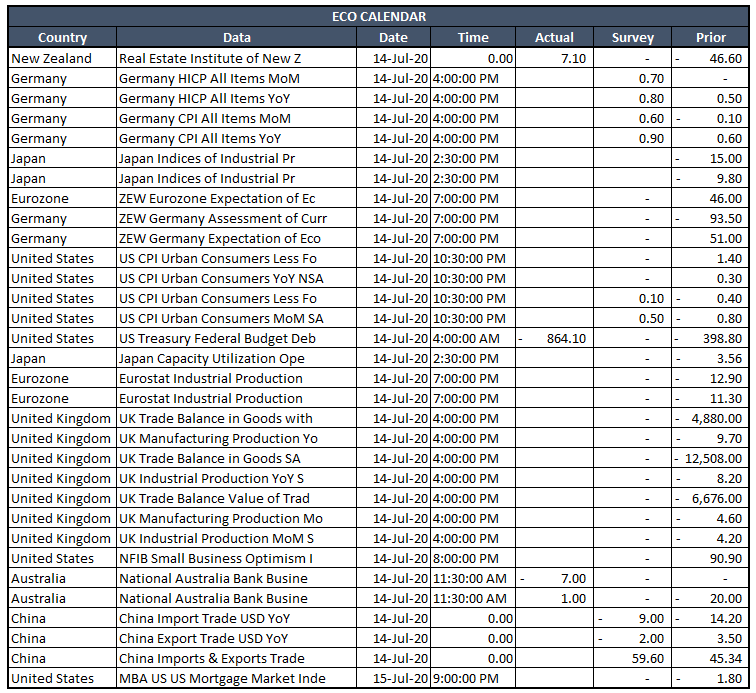

Some might have the luxury of sleeping, but if you were to watch the price action of US stocks, you’d find they’re still fairly volatile intra-session. It’s why VIX (Volatility Index) is held up near 30% and proves why we aren’t in a straight line rally anymore. We’ve addressed the reasons before, but besides 2nd wave and China vs World in tariffs/accusations/security and potential vaccines, where the tyres now hit the tarmac are in earnings. The latest numbers by banks aren’t so impressive and are pushing speculators into 2 minds about the sustainability of a rally. US Retail Sales is also on the agenda to address… the bounce has been spectacular, but again, once the stimulus measures are wound back, we could come back to harsh reality that neither COVID is going away fast NOR can we expect a fast-track recovery economically.

Locally, we got to analyse this week’s data such as confidence and unemployment. Business Confidence was better (pre-Victoria isolation), Consumer Confidence weakened for July, Unemployment as well. The devil in the details for unemployment was again the participation rate – up to 64% from 62.7% … believe it or not, that’s a massive swing as 210k jobs found still led to a 0.3% rise in unemployment. What the market didn’t like more, was the fact it was all part timers. It would make sense given the service sector got hit the hardest and as such, lost 162k part time jobs the month prior. What we need now is to look at retail sales (stimulus adjusted) and sadly, the very late data of GDP to see how hard it’s really hit. We could very well be nearing an inflection point of markets vs economic convergence, which means we’re in for a bumpy few months.

Have a great weekend!

Contact the Inside Track Research Team for more info: +61 2 8916 6115