Market Update: 28 July 2020

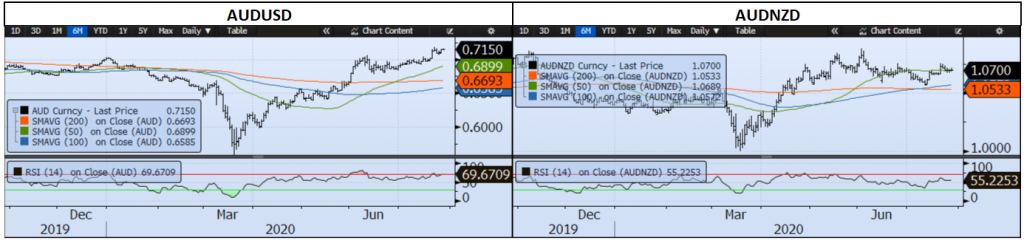

As Gold moves higher, you have to question why and how? Is it a simple old-fashioned stop-loss target practice or is it telling us something? Well it would seem a bit of both…

As we look at correlations below, it’s become a beacon for anti-deflation, risk-off and plain and simple USD selling. In the 1st chart you can see Gold and Bitcoin having a pretty strong co-existence as markets grapple with 2nd wave and where to deploy capital.

Gold vs Bitcoin

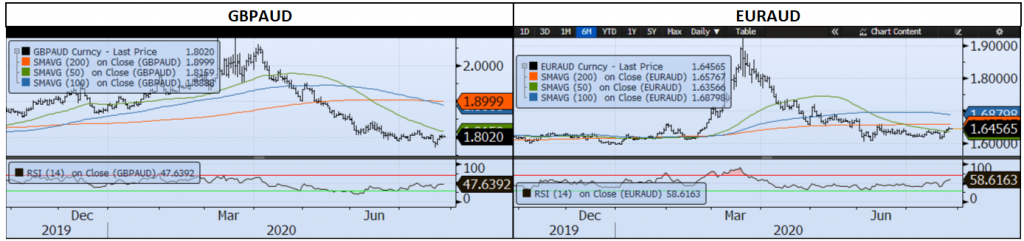

In the second chart we can see it’s certainly borne off negative USD sentiment.. although this can be the same story. During COVID (and GFC), repatriation to USD whilst everything sold off was the 1st reaction – but as markets redeployed capital, it was most evident in the likes of the S&P and Nasdaq… it’s not though as evident in ASX for example which is yet to give back losses from March.

Gold vs USD Index Inverted (DXY)

So looking at Gold vs S&P, we then see perhaps it’s merely in catch-up mode, but S&P is certainly losing some momentum and reiterates the AUD correlation with S&P has broken down a bit and is more aligned to USD selling. What it does mean though is that both can rally, but they can’t both claim a risk-off theme – unless you consider your portfolio to be long risk with S&P with Gold as an imbedded put option.

Gold vs S&P

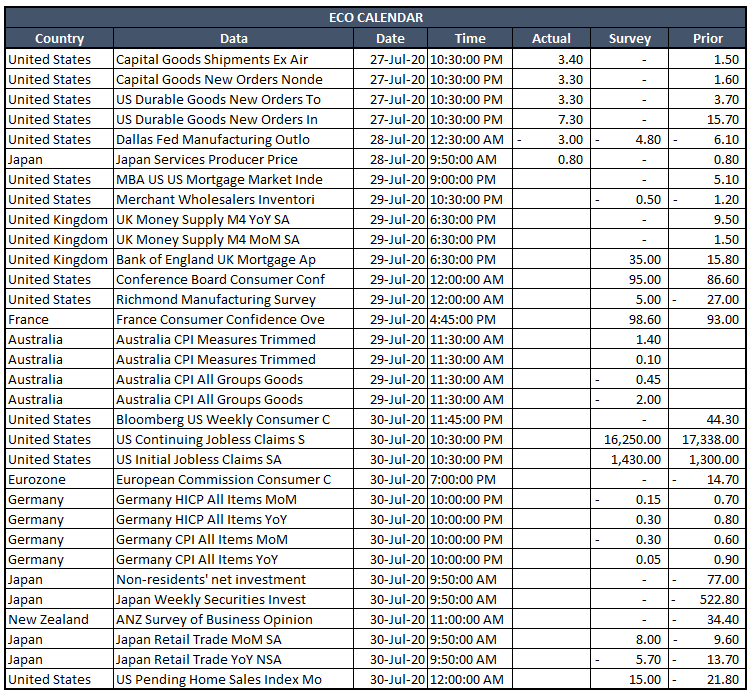

We have a big week ahead.. Aussie CPI, US GDP, and FOMC alongside Apple and Alphabet earnings. If the initial moves are about anti-deflation – we might see some profit-taking before a bigger move.

Title from the song: Gold – Spandau Ballet

Contact the Inside Track Research Team for more info: +61 2 8916 6115