Market Update: 21 August 2020

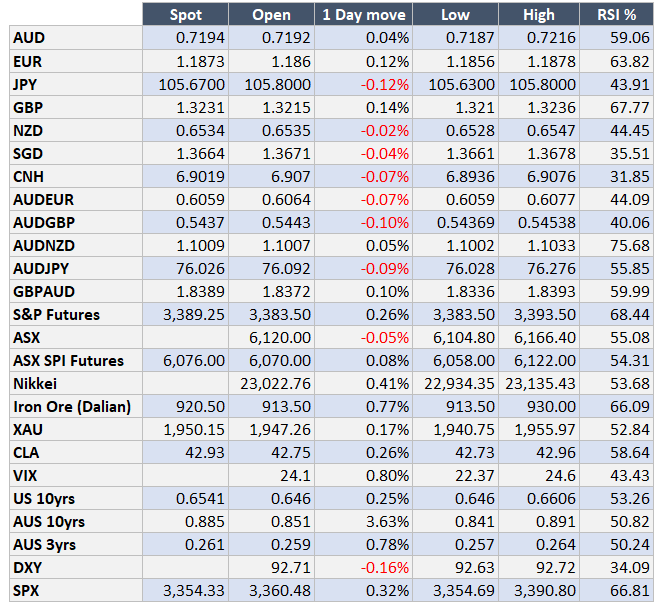

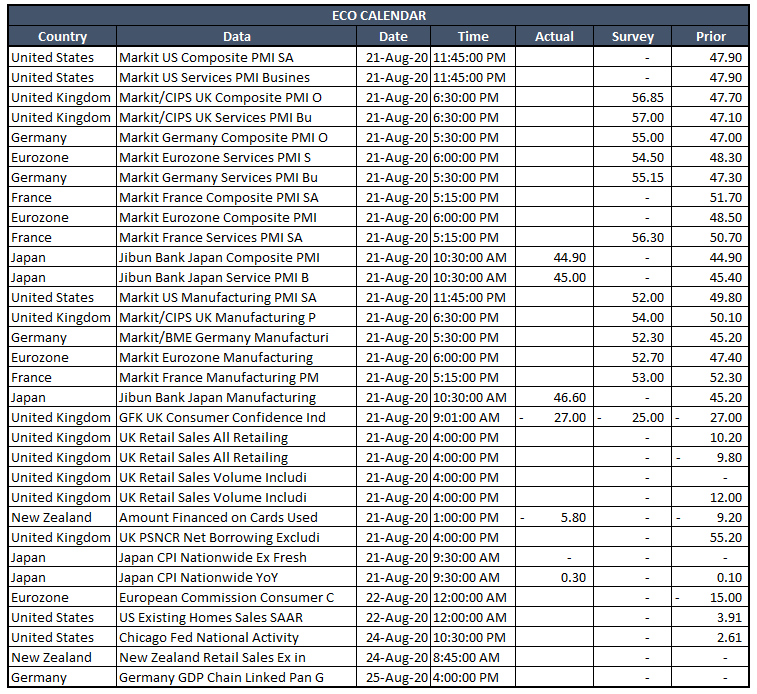

The markets have gone full circle this week dominated by the US…. the Fed Minutes disappointed with no intervention in the longer dated bonds and despite the talk of greater transparency, did not have too much to offer. Markets found this a signal to again trade bonds and in-turn push the DXY higher. Now look to September for guidance.

It doesn’t surprise as again; we price to perfection and get upset perfection doesn’t exist. It’s a big risk for Q1 2021.. we get a vaccine (hopefully) and then what?? we look to the economy and realise we have an uphill battle. Onshore, the scheduled end of Jobkeeper and banks asking for interest repayments so it could be quite a tumultuous time.

We also had a mixed jobless claim showing a higher than expected initial claims and although losses were predominantly clawed back beforehand, the market sought to punish. This though was also faded. What does this teach us? again, the trend is your friend. We may forecast stock market falls and everything that correlates with it, but it remains short-lived.

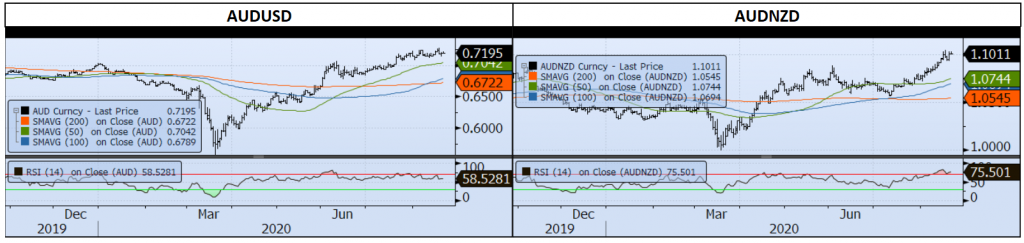

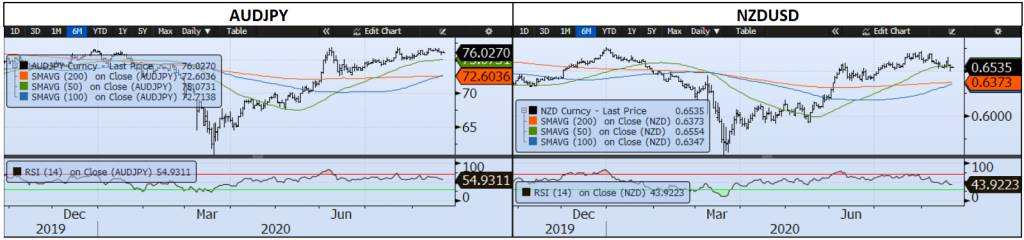

RBA minutes also out reiterated the same stance, it’s still sobering to see how long they expect a return to normal for jobs and growth. Despite all that, RBNZ tried harder to dissuade investors in buying their currency, and as such AUDNZD pushed through 1.10 as the conversation about negative interest rates continued.

Although we are seeing Gold below 2,000 it would still seem we are running the bond theme as a proxy for USD and as such GBP outperforming despite Marks and Spencer layoffs during the week. It’s prospering despite itself against USD.

Have a great weekend!

Contact the Inside Track Research Team for more info: +61 2 8916 6115