Market Update: 2 June 2020

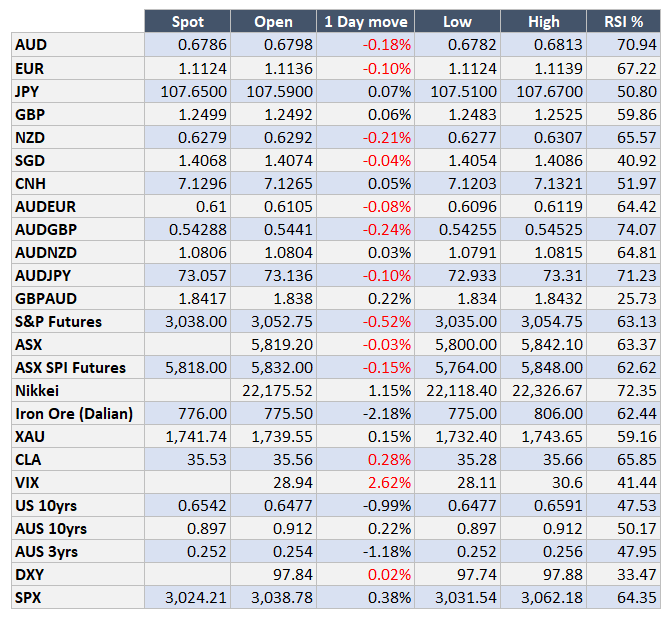

In a combination of Global Equities continuing their rally, so has the AUD, EUR, NZD, GBP, JPY… Gold, Oil, US 10yrs .. all pretty much at the cost of USD.

Despite the continued rhetoric between the US and China – with the US now talking about putting extra tariffs on Hong Kong as the perceived independence from China has diminished, despite China threatening to stop imports of US soy, despite China now threatening UK with trade sanctions alongside Australia after also calling for COVID investigations and despite Trump threatening to call in the National Guard for protests across the nation, the market Bulls have had their day in the sun.

Why? We’ve attempted explanation of this before being the combination of short-term money driving the moves and now macro funds would’ve had their fingers burnt being short risk explaining the next leg up in a bout of stops. It still comes down to the wall of money waiting on the sidelines to be deployed . . . cash at 0% is not compelling when things are healing. Despite a 33% increase in COVID cases from a fortnight ago, an increase in deaths by 19%, recoveries are getting some traction to 46% (excl UK and Netherlands).

No matter what from here, the uptrends remain in place… there may be some corrections on the way, but the catalyst to see new lows would be in the vein of a 2nd bout of COVID cases or economic data lagging the market optimism…. well that sort of is the case at present, but we’re all too willing to forget about the past for now and although Q2 data will not be pretty, the markets will likely be forgiving until Q3 data comes along.

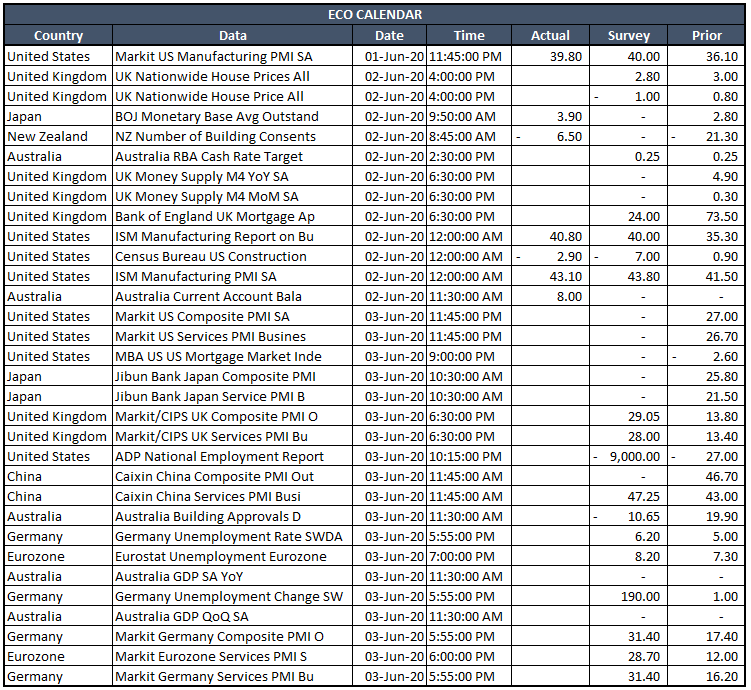

We have seen improvement in the weekly ANZ consumer confidence up to 98.3 from 92.7 as states bring in early opening, we have the RBA today as well whom we believe will sound more optimistic, but still want to push the point of lower rates for longer. We also have GDP tomorrow – but it’s for Q1 and so much has happened. For the record, the markets are at -0.4%, but in reality, only the latter half of March was affected domestically, so it may come down to Chinese New Year as an anomaly to this number and in reality should be overlooked except the title of 1st negative quarter en-route to a technical recession.

https://www.youtube.com/watch?v=3L4YrGaR8E4 – refers to America’s aggressive military tactics and the quote after an SNL performance “American democracy is inverted when your only choice is between wealthy representatives of the privileged classes.” I prefer the original although the Denzel Curry version brought the song back to life and perhaps current events too.

Contact the Inside Track Research Team for more info: +61 2 8916 6115