International investments have created vast opportunities and can be a great way of diversifying. However, there are additional risks attached, and if not managed purposefully, international investments can eliminate returns.

That risk is currency.

Currency fluctuations can outweigh the efforts made in your entire investment process. Yet, if managed correctly, it can add value and even act as a buffer to negative returns in the underlying asset class.

There are various methods by which creating a currency overlay program can add value:

Passive management

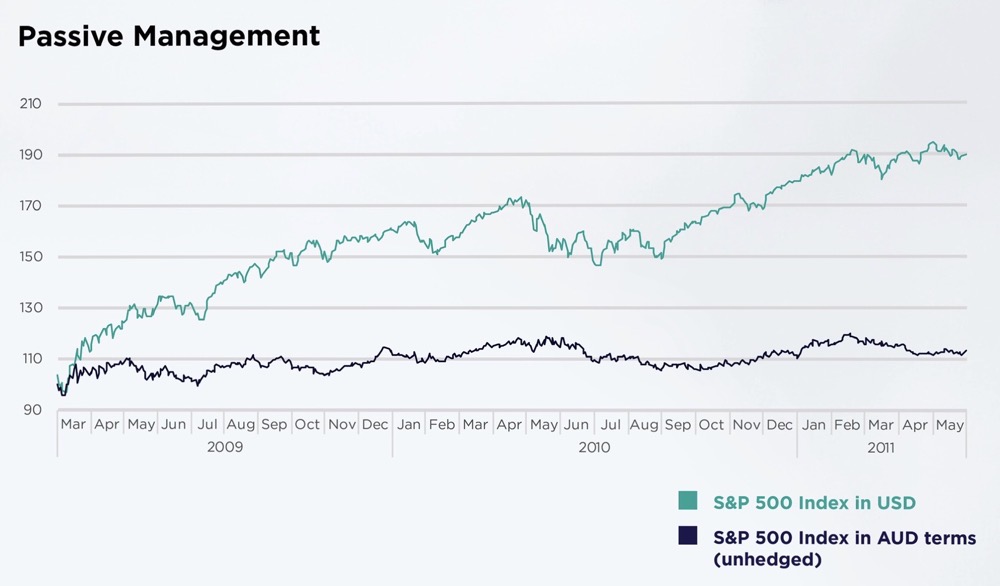

This method is used as a ’least regret’ to either participate in some currency fluctuation or none at all. For example, a bond investment tends to be a fixed income that experiences lower returns than currency. Therefore, to mitigate the risk of currency overwhelming the returns of the portfolio, it is preferred to be approx 100% hedged. Should it be an equity portfolio, there tends to be a correlation for AUD/USD to S&P, so equity investors may opt for a 50% hedge ratio to buffer any fall in stocks with an offsetting gain in USD against AUD. In contrast, this option can deplete returns in times of stock market rallies, and its effectiveness is not constant and dependent on correlations.

Passive management is also more suited to income, as opposed to absolute return focused investments

Source: Bloomberg

Dynamic management

This method is a proactive adjustment of hedging ratios aligned to changing market conditions in the currency market and underlying assets. For example, investing in S&P from 2009 – 2013 caused a 70% hit to returns by having no hedge in place. Conversely, in recent times, stock market falls have buffeted stock market losses for unhedged Australian investors, as the AUD dollar fell over 20% from 1st Jan 2020 to late March.

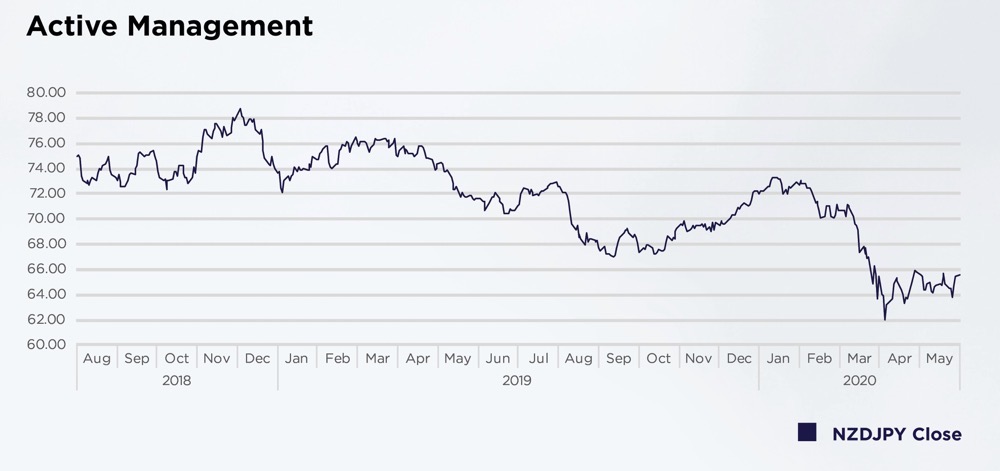

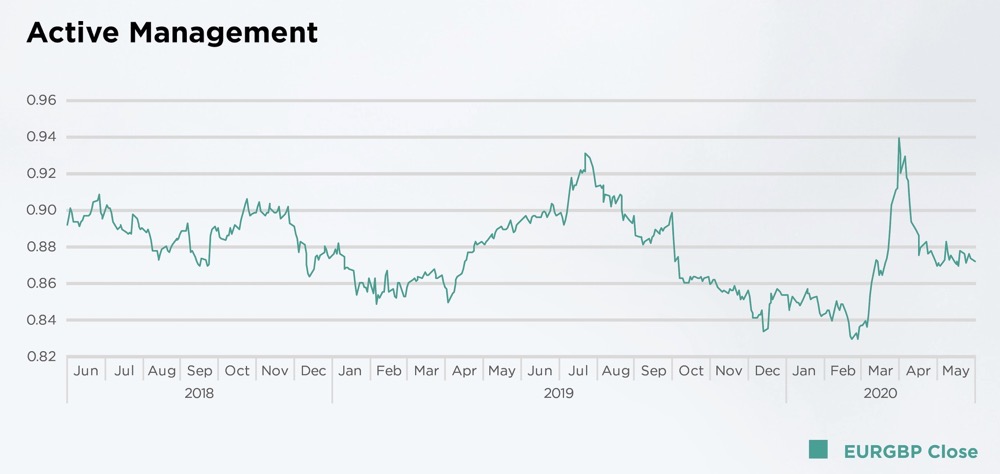

Active management

This method is where the currency exposure of the investment is used to generate an additional return (Alpha); not all funds are simply AUD/USD exposures. There are plenty of opportunities to gain returns on currency as an asset class, by investing (and divesting) from multiple currencies with intent to provide an additional return. For example, selling NZD/JPY as risk aversion and border closures meant NZD would see a reduced cross border flow vs JPY – this saw repatriation occur and meant the pair saw almost a 20% return. Alternately, a relative value trade where EUR outperformed GBP by 15% (as EUR is considered a safe haven). This, in essence, is an Alpha generator.

To effectively manage the currency impact to any offshore asset portfolio, it’s essential to understand the nature of the underlying investments and their particular characteristics.

To develop an effective currency overlay strategy, whether you’re seeking to strip out risk, diversify your portfolio, or use currency exposure to drive returns, contact our Overlay Team on +61 2 8916 6115 to discuss.