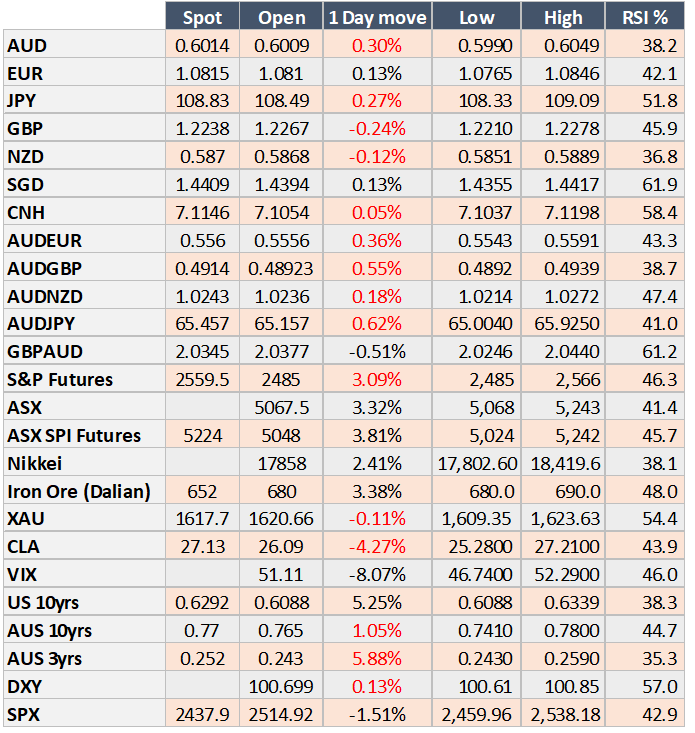

Market Update: 6 April 2020

We have been in a Tardis of late, seeing into the future of a COVID world as countries before us experience cases, reactions of shutdowns, deaths and subsequent recoveries. We’ve also implied that on our own soil to reflect best and worst case scenarios as they evolve and ramifications of not social distancing or self-isolation – so perhaps that’s why when the markets saw a 701k fall in Non-Farm Payrolls, we were too busy considering the future.

Inside the Tardis it’s deceptively larger than anticipated and akin to the data we pore over daily, some is distracting and takes away focus.

Yes, S&P fell 1.5% (as did AUD to 0.5980) but futures have taken it back plus another 1.5% for good measure. Why? Because we’re told that number of cases by percentage terms are starting to fall and although Trump warns of a rough two weeks coming up, the data supports a peak. In fact, over the past 4 days alone, there was a 50% increase in global deaths.

The not too distant future is marred with hospitals that may not cope, higher deaths and news reporting how the world has stopped. Politicians like to talk about their joyride in the Tardis and the future they see -without necessarily putting a date on it, but how incredible it is.

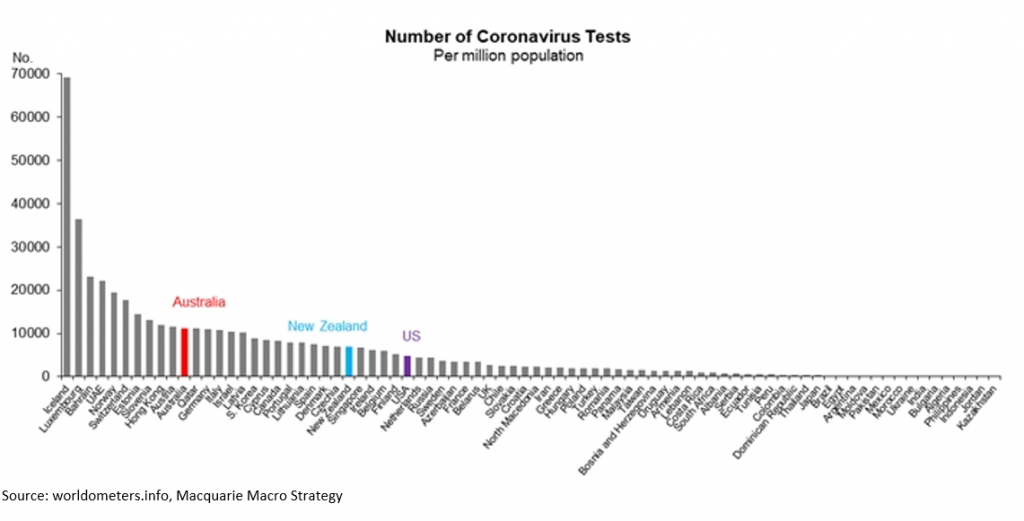

We can only guarantee reality and what needs to be considered to get us to the future – such as suffering now to get us there, but countries that reflected too long on their success – such as Singapore, unveiled complacency and their numbers moved up again. So as below, those who take stock of how many are truly infected (and do something about it), can call an end to some isolating measures.

How does that translate into financial markets? VIX is the measured level of fear that things will move – it has for now abated, but still well above average. So soon we’ll look to a point that it’s too expensive to be bearish – such as the 1-day corrections we’ve seen since 2013 as QE floods the world and compels participants to go long risk. It’s nice to think of it – infact traders daydream of it, but for now, VIX tells us reality is a bit bearish.

VIX:

Cboe Volatility Index® (VIX) is a calculation designed to produce a measure of constant, 30d expected volatility of the US stock market, derived from real time, mid-quote prices of S&P 500 Index (SPX) call & put options. SPX & SPX Weekly’s options with >23 days & <37 days to expiration

Contact the Inside Track Research Team for more info: +61 2 8916 6115