Market Update: 31 August 2020

Again China is implementing ways to gain revenge on Australia after being part of the conglomerate of nations wanting an investigation by the WHA into COVID origins and then the Federal intervention on Victoria’s Belt Road agreements. It was grains, then beef alongside comments on their students studying in Australia and now China has announced a probe into Australian Wine over subsidies.

This is not to say though that Iron Ore demand has abated… it hasn’t and there is still a protein shortage that China has to contend with. So is this just all huff and puff or will it affect the Australian economy in the future? Probably a mix of both, but that’s why Australia is furiously looking for new trade agreements globally in case of such shortfalls. At the end of the day, the newly built alliances who don’t want to be at the mercy of China, will try for co-reliance.

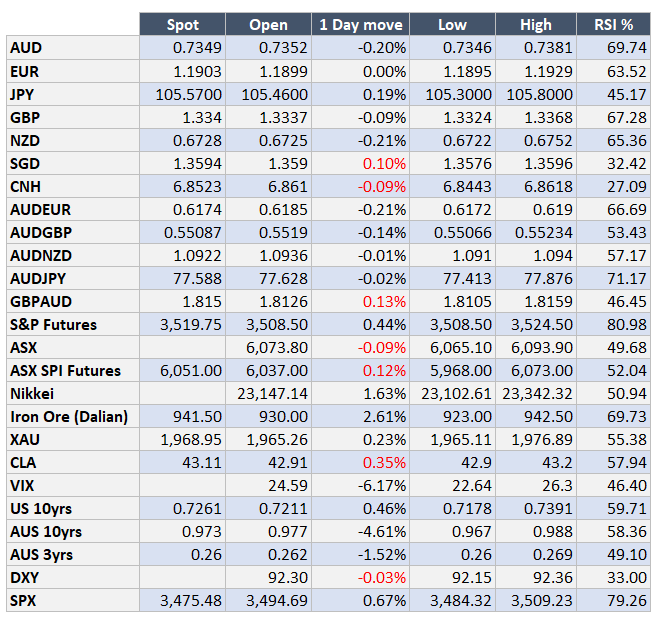

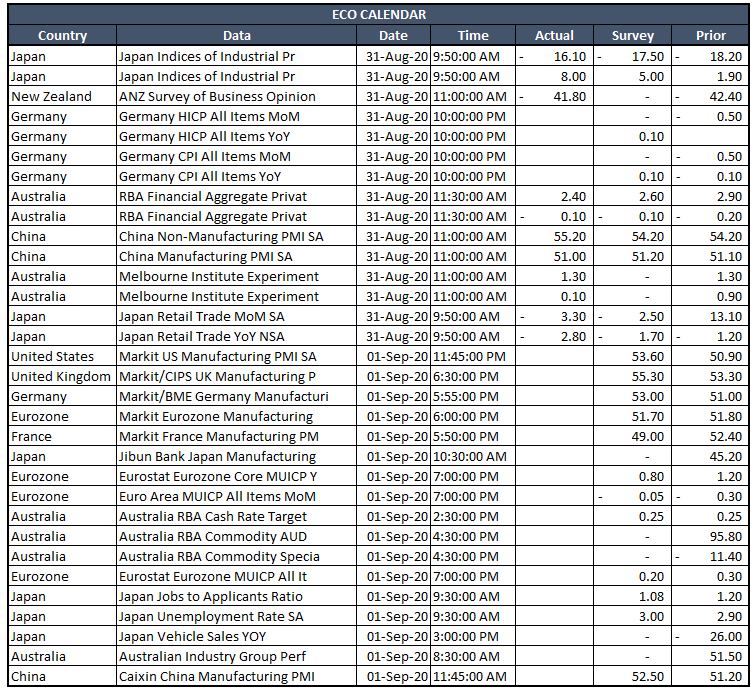

Speaking of which, China’s PMIs came out on balance better but the headliner of 51.0 for Manufacturing did disappoint by 0.2.

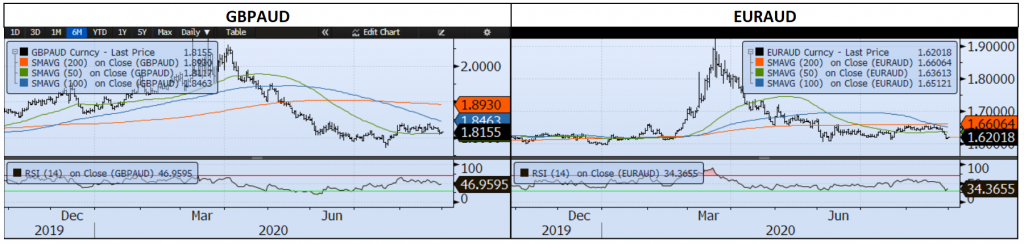

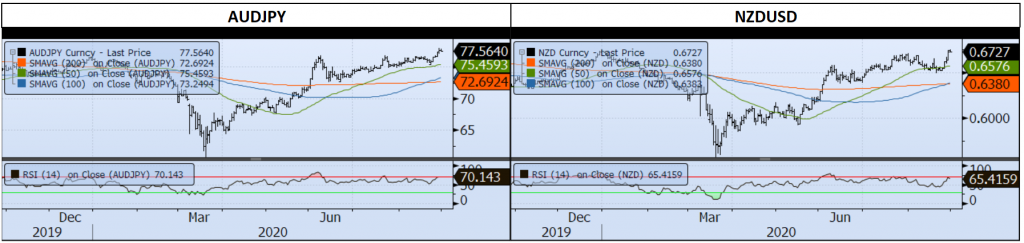

Japan’s Abe – who created his own economics now leaving for health reasons actually led to USDJPY falling and in turn DXY falling across the board to allow AUD a leg higher. As we come into month-end it may even test up to 74c, but just as easily correct. The bottom line – although a bit overbought, the trajectory upwards remains intact (despite China).

The week ahead… RBA – already! Mostly everything has been said through the month. It would be very surprising to hear anything new. We also have GDP for Q2, but it was mixed with both lockdowns and reopens so it’s anyone’s guess and I’m not even sure it will make a difference. We also have UK credit, US ISM and Eurozone CPI.

Good luck for the week ahead and happy Spring for tomorrow!

Contact the Inside Track Research Team for more info: +61 2 8916 6115