Market Update: 15 May 2020

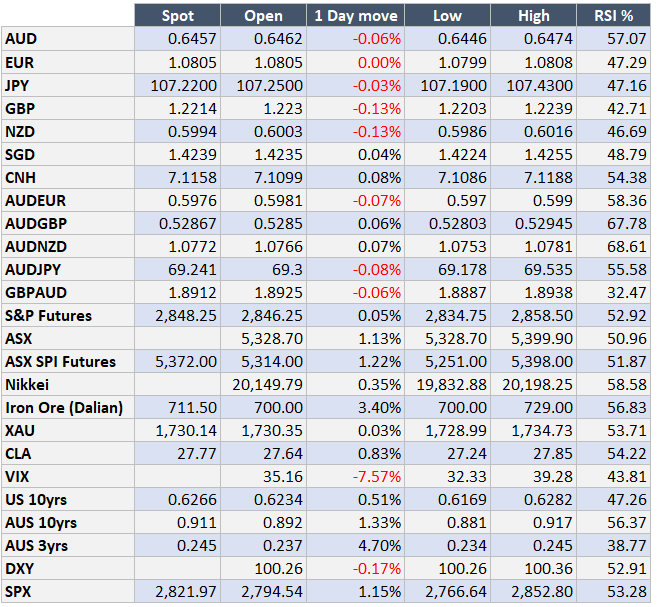

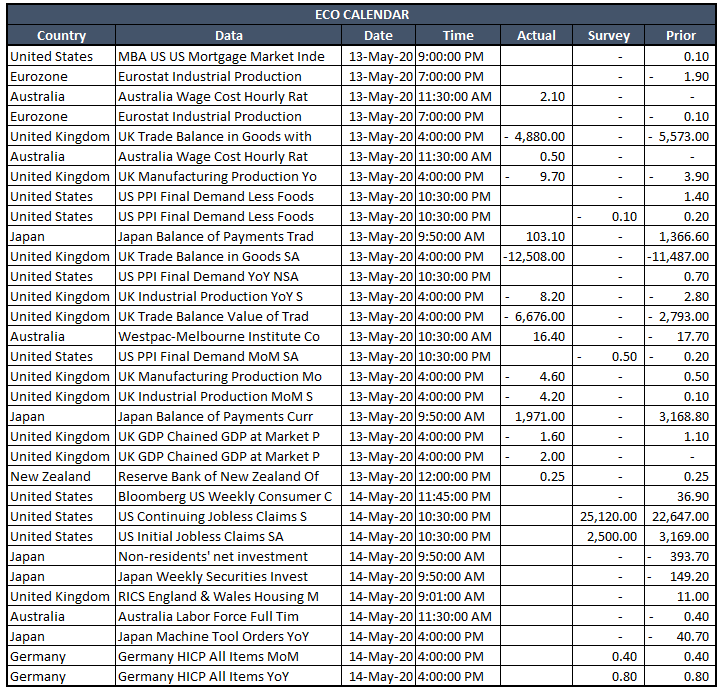

As we round off the week, the highlights include Fed Reserve telling us to be more patient on recovery (as does Dr Fauci), US initial claims higher than expected – although continuing claims lower, Trump sounding his displeasure with China, Australian exports at risk of a Chinese backlash alongside a better than expected Oz Unemployment Rate… but skewed by the participation rate.

As we mentioned in last month’s assessment of Unemployment, the participation rate for once was going to be interesting and that it was… most economists copy and paste the previous print but given the change in landscape, estimated to be 65.3% from 66% – it actually came out as 63.5%. What did that mean? well as background, ABS survey asks the question if the person is actively seeking a job, and given many have been stood down and hoping to go back, the response would be “no”. This though at 66% participation would’ve seen the 6.2% print be more like 9.6% Unemployment according to ABS. The next few prints may be the same until JobKeeper support wanes or companies move from “stood downs” to redundancies.

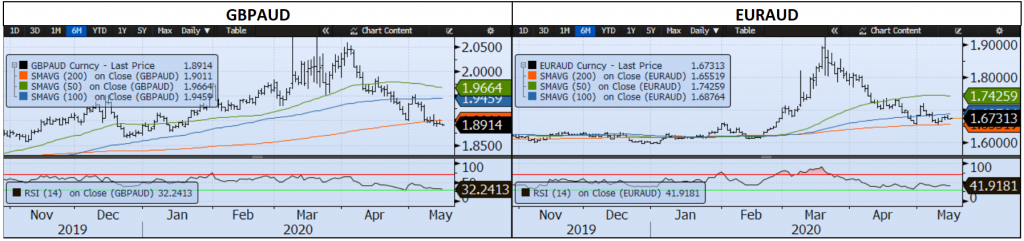

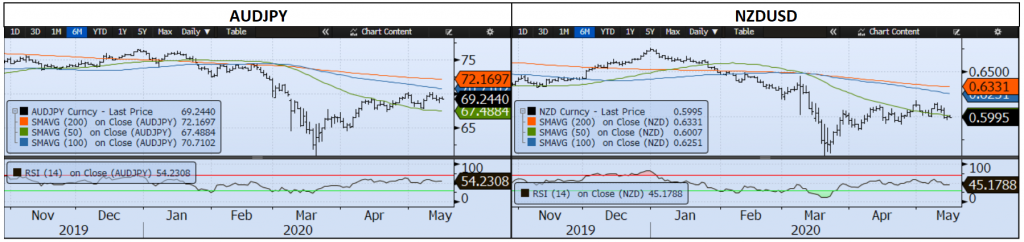

So this has left AUD modestly lower for the week after again failing to break up above 65c. This is reflective in Stocks as well but there has been Fed Reserve support in ETFs (not sure why at these levels, but it had been heralded). Things feel heavy given there’s enough negative rhetoric – it again will come down to who the participants are… should it be short-term traders, we’re likely to see narrow ranges for now with a buy-the-dip mentality prevailing, but as the poor data continues, the negative theme would likely re-emerge.

Have a safe weekend.

Contact the Inside Track Research Team for more info: +61 2 8916 6115