Market Update: 27 October 2020

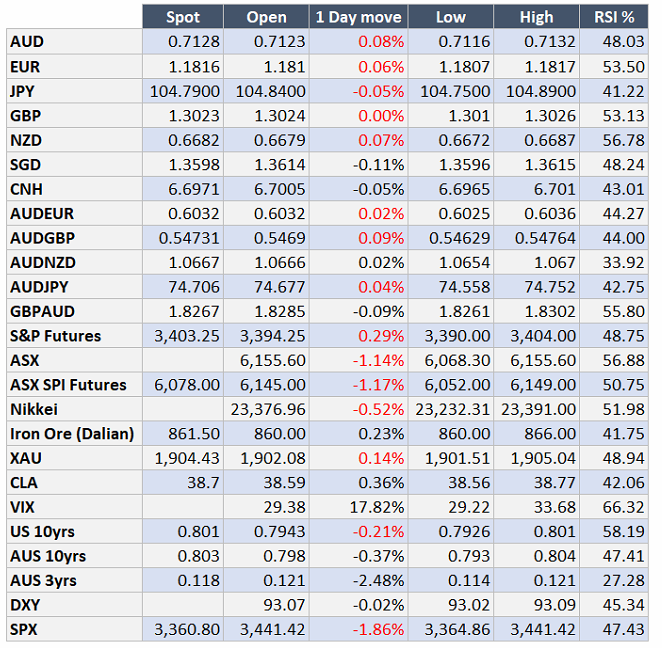

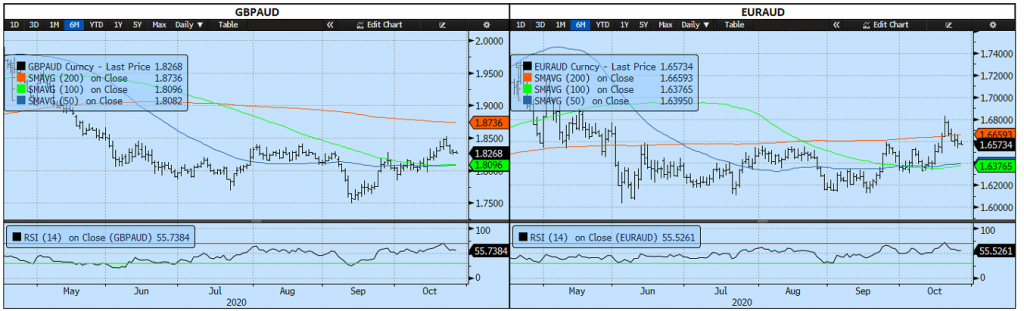

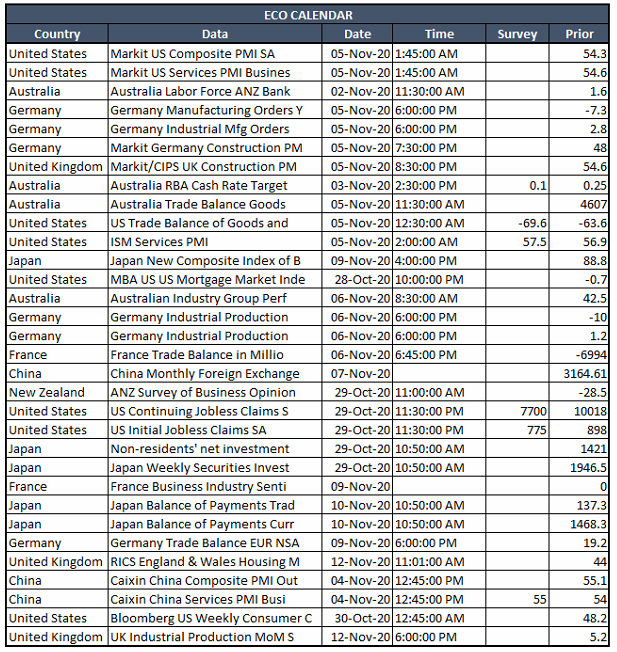

Risk off price action was prevalent overnight, as the US stock market suffered its biggest loss for a month on concerns that any economic stimulus package will be delayed until after the election. Risk appetite was also hampered as COVID cases once again escalated across Europe and North America. Despite this, the AUD has been holding up remarkably well, in our opinion it’s being supported by strong commodity prices and also hopes that a Democratic victory will prove positive for China relations and associated trade disputes.

There remains plenty of headline risk between now and the end of the year, and as such we expect a volatile range in the AUD to persist until then when a resumption of the AUD/USD uptrend is expected to unfold. While the AUD remains below 0.7170 near term risks are skewed lower and breach of 0.7000 support could open up further losses towards 0.6800.

Contact the Inside Track Research Team for more info: +61 2 8916 6115

The information contained in this report is provided by Rochford Capital Pty Limited – ACN 143 601 594, AFSL 361276. This report is provided for general information purposes and is solely intended for use by persons who are Australian wholesale clients. To the extent that any recommendations or statements of opinion constitute financial product advice, they constitute general financial product advice only. As such, any advice contained in this report does not take into account your objectives, financial situation or needs. You should consider whether this advice is appropriate for you, and seek independent professional advice before making any investment decision.