Derivatives are extremely volatile, which can cause adverse movements in fair-values and cash-flows to the detriment of reported earnings, and consequently the share price.

This post explains the undesirable impact on accounting when a Forward Foreign Exchange (Forward FX) contract is used to hedge exchange rate risks. It outlines the optional provision under IFRS 9 that allows an entity to mitigate these consequences through Hedge Accounting.

To apply Hedge Accounting under IFRS 9, an entity has to comply with documentation and adopt certain accounting treatment over the life-cycle of the hedge relationship.

Accounting for Forward FX Contracts

A Forward FX contract is considered a financial derivative. Under IFRS 9, a derivative must be initially measured at fair value and subsequent value changes are recognized. Unless you are applying hedge accounting then movements must be posted to the profit or loss account.

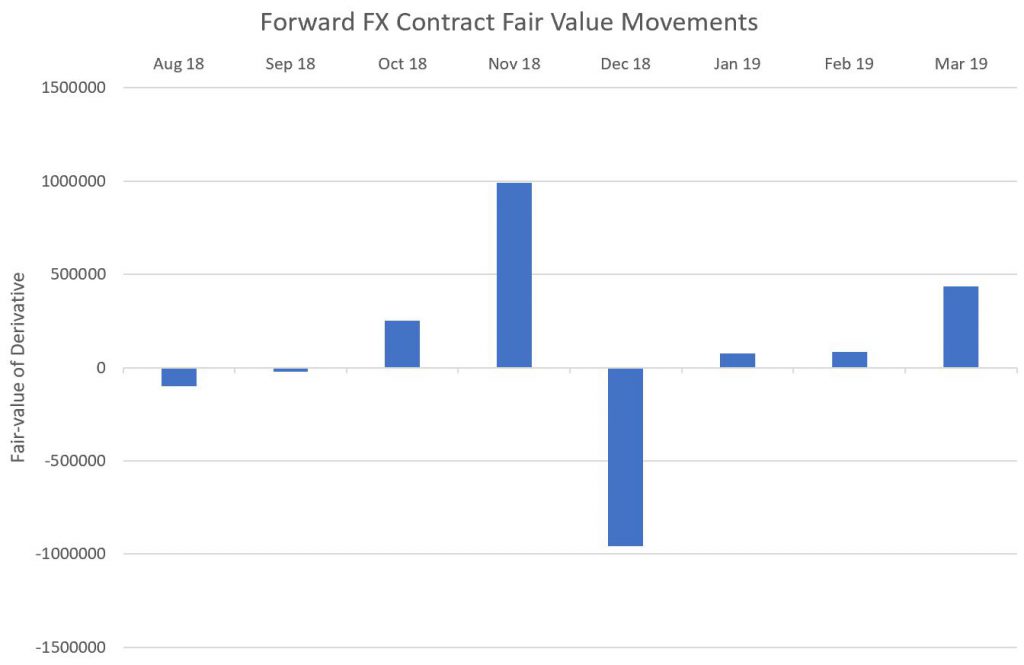

It is not uncommon to see period movements of a Forward FX contract to change dramatically, show graphically below:

The above fluctuation can distort reported profit and loss and true business performance for the period.

Accounting for A/R & A/P

When a forecast foreign currency exposure crystallizes and becomes an Accounts Receivable or Accounts Payable, it is recorded in the equivalent base currency amount using the prevailing “book” rate. At each period end, the accounting system will automatically revalue any unpaid CCY receivables or payables using the period’s current closing rate and restate the base carry amount.

This is referred to as monetary asset adjustment which is a standard practice to apply on all monetary items including A/R, A/P, loans and deposits. Monetary asset adjustments can significantly offset the gains and losses arising on any Forward FX contract revaluations.

However, unlike A/R & A/P, a forecast will not give rise to mirroring journals to offset those from the Forward FX contracts.

This asymmetric accounting treatment causes fluctuations in reported earnings – which is where applying hedge accounting can be beneficial.

Hedge Accounting Principles

The accounting standard-setting authority gives the entity the option to mitigate the accounting mismatch described above by adopting Hedge Accounting.

The primary goal of Hedge Accounting is to ensure that the effect of bona fide economic hedging is reflected in the accounts so that they present a true and fair view of the affairs of the company.

More specifically:

- The company may defer the unrealized gain/loss on Forward FX contracts to the Hedge Reserve account on the balance sheet instead of impacting reported profit and loss.

- The Hedge Reserve balance is then released systematically to the PnL Account in such a manner so that sales (A/R) or cost of sales (A/P) is correctly stated at the hedged rate instead of the system booked rate

Hedge Accounting Criteria

The following conditions must be satisfied to adopt Hedge Accounting:

- Financial instruments used for hedging and hedge items must be eligible.

- Formal documentation is required of the overriding risk management objective and methodology. At the inception of each pair of hedge and hedging item, the entity must formally record the hedging relationship.

- Documentation should include effectiveness assessment that has to be performed on inception and at each reporting date.

WHAT OUR CLIENTS SAY:

“We are delighted with the work Kevin and the team at Rochford have done for The Institute in relation to our ongoing hedge accounting requirements. Rochford’s proactive approach and independence ensured we had accurate mark-to-market valuations and that our hedge accounting strategy was aligned to the commercial risk management objectives, resulting in minimised hedge ineffectiveness to profit or loss.”

GANEN NADARAJAH | GROUP FINANCIAL CONTROLLER | THE GEORGE INSTITUTE FOR GLOBAL HEALTH

If you are facing these challenges or would like to find out more, contact Rochford and begin your treasury improvement journey today >>