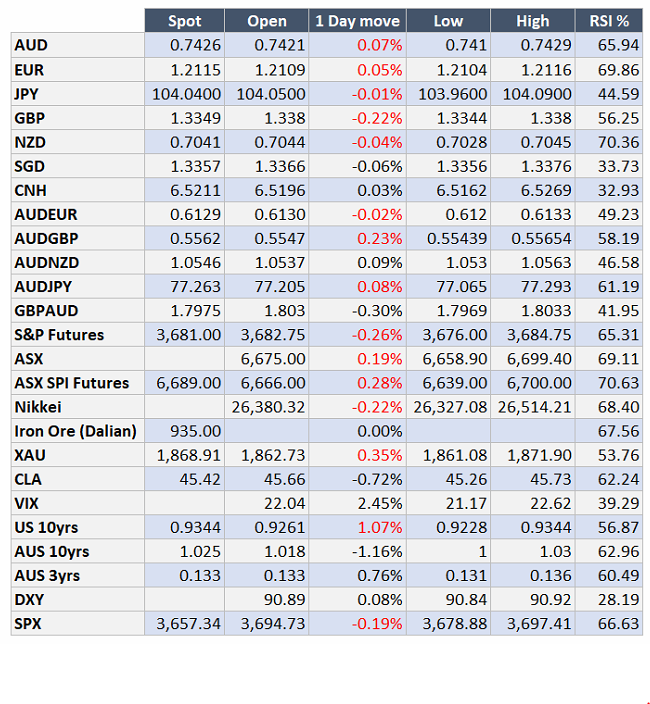

Market Update: 8 December 2020

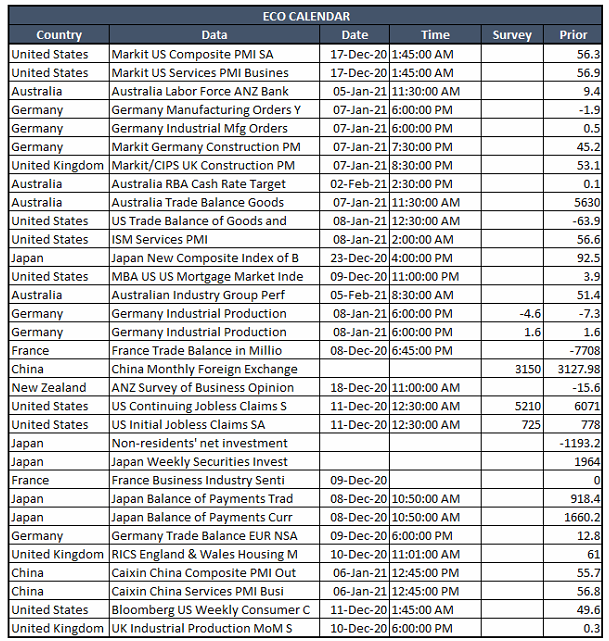

- Global policy makers are failing to get deals done. In Europe the BREXIT trade deal hangs in the balance and in the US law makers cannot agree a stimulus deal. Both are vital to the post COVID economic recovery

- Despite positive Vaccine headlines, COVID is certainly not under control in the US, hospitalisations are currently climbing by 2000 per day!

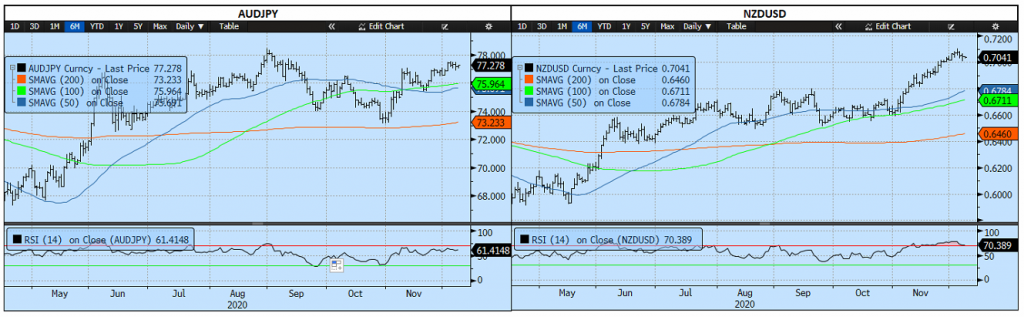

- Given the huge surge in Asset prices, some profit-taking into year-end would not be surprising and this could well yield a dip in the AUD. However, any such dip would be viewed as buying opportunity within the context of our 2021 outlook

Contact the Inside Track Research Team for more info: +61 2 8916 6115

The information contained in this report is provided by Rochford Capital Pty Limited – ACN 143 601 594, AFSL 361276. This report is provided for general information purposes and is solely intended for use by persons who are Australian wholesale clients. To the extent that any recommendations or statements of opinion constitute financial product advice, they constitute general financial product advice only. As such, any advice contained in this report does not take into account your objectives, financial situation or needs. You should consider whether this advice is appropriate for you, and seek independent professional advice before making any investment decision. Past performance is not indicative of future results.