Market Update: 11 September 2020

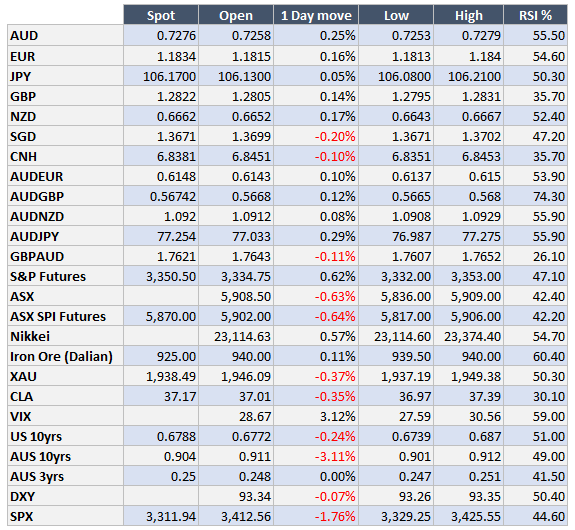

A continuation for tech to consolidate has pretty much left most share markets lower/close to flat for the week and whilst the majority of the time there wasn’t much to trade on, this week we experienced a few themes.

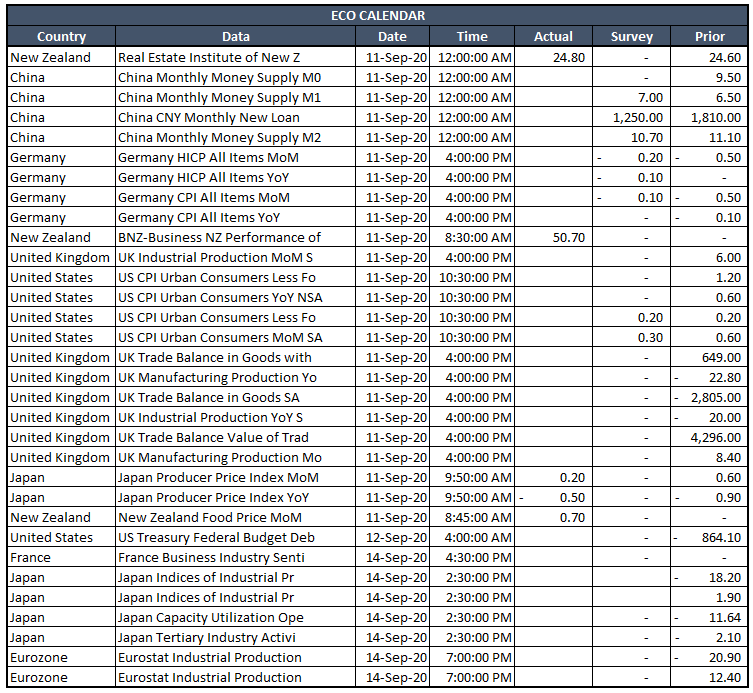

We’ve had Astra-Zeneca put the ever-important COVID Vaccine test on pause – this is though a normal occurrence when someone has an adverse reaction in trials, but as they say, it’s never garnered more attention than now. We also saw some brinkmanship across UK-Europe Brexit talks and this should be expected as we move towards mid-October unless a deal is struck earlier. A few more shots across the bow with US-China relations as relations continue to deteriorate. Finally, we’ve had a worse than expected Jobless Claims out of the US.

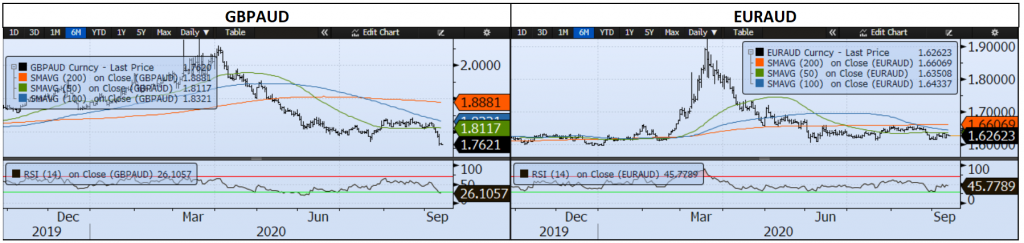

As a whole, you might even say, despite it all, most markets got out relatively unscathed – but techs got hurt by 5%, Tesla was down 25% at a point whilst local Fintech Darlings Afterpay are down 24% from peak. Second to that, GBPUSD certainly found no friends either and GBPAUD explores the 1.76 level.

If you can’t completely explain its rise – it’s easier to describe it’s fall in one word… consolidation. It certainly is though going to be a whippy next 2 months as we see Northern Hemisphere holidays end, Brexit deadlines and US presidential elections to contend with. If anything, buying Vol makes most sense… but that’s already started to move higher.

Have a great weekend!

Contact the Inside Track Research Team for more info: +61 2 8916 6115