Market Update: 19 November 2020

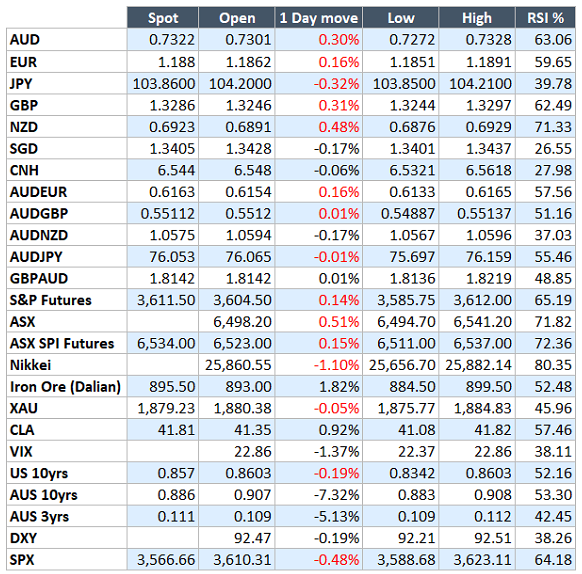

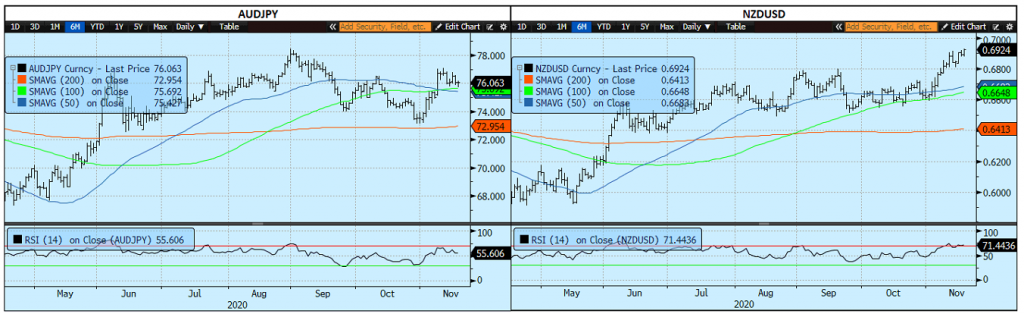

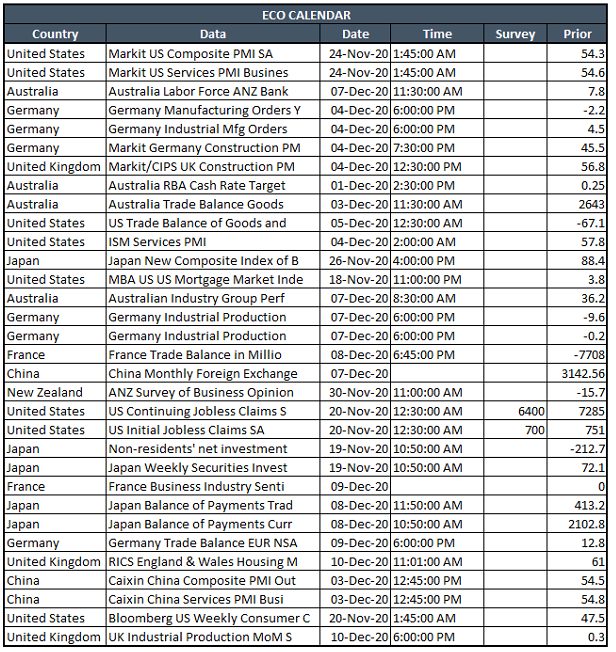

As both Pfizer and Moderna show very encouraging signs for their vaccine, the pandemic is escalating in large parts of the world, with Tokyo on the verge of lockdown and France reaching 2million cases. The AUD is trading in pretty close step with global equity markets and in a similar risk-on/risk-off fashion as it did in the wake of the GFC. There remains plenty to cause fluctuating risk appetite in the months ahead and thus we expect the path for the AUD to be volatile, however, following a broad trend of appreciation; that could see AUD/USD hit 0.7500 before Christmas.

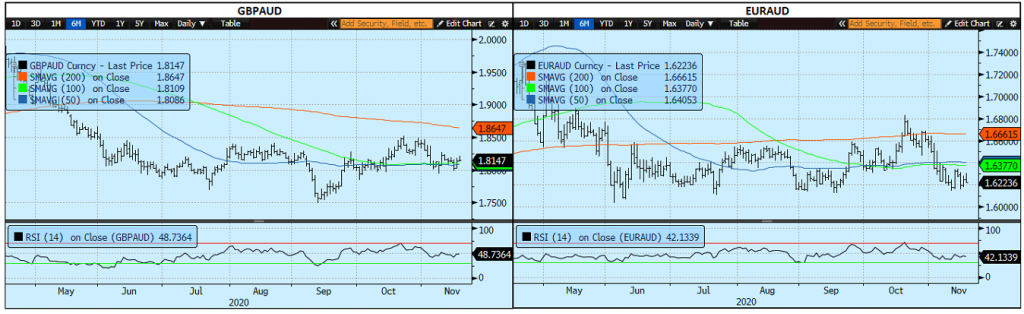

Elsewhere, it appears that the UK is close to reaching an agreement with the EU, with a deal likely to be signed early next week, which will in turn be good for the Pound, however more against the USD and Euro than the AUD. Being out of the European Bureaucracy arguably gives Britain more flexibility with regards to its economic stimulus options and thus we favour an outperformance of Sterling particularly against the Euro In 2021.

Contact the Inside Track Research Team for more info: +61 2 8916 6115

The information contained in this report is provided by Rochford Capital Pty Limited – ACN 143 601 594, AFSL 361276. This report is provided for general information purposes and is solely intended for use by persons who are Australian wholesale clients. To the extent that any recommendations or statements of opinion constitute financial product advice, they constitute general financial product advice only. As such, any advice contained in this report does not take into account your objectives, financial situation or needs. You should consider whether this advice is appropriate for you, and seek independent professional advice before making any investment decision. Past performance is not indicative of future results.