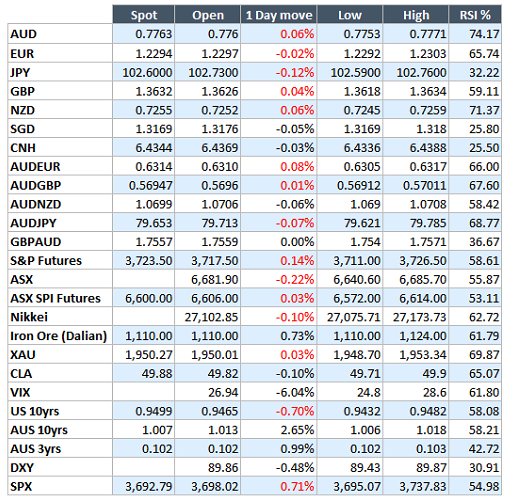

Market Update: 6 January 2021

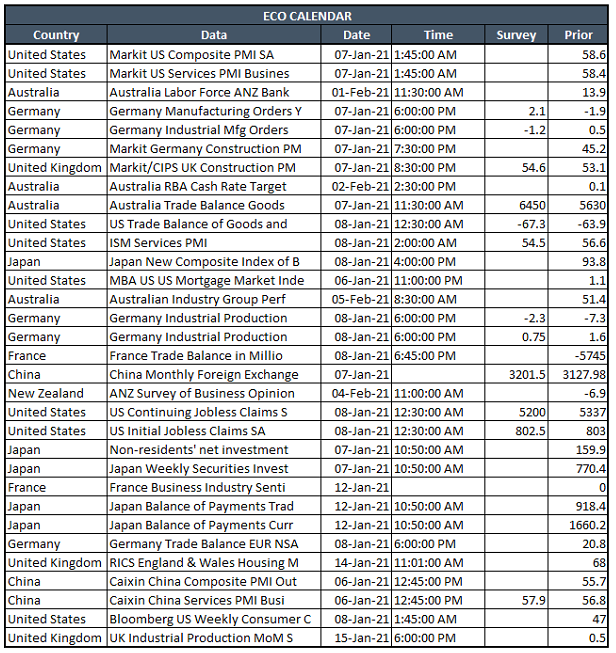

- COVID is once again resurgent with many western economies going back into Lockdown. While we ultimately expect the various vaccines to curtail the virus, the immediate prospects look grim and could certainly contribute to market volatility in Q1

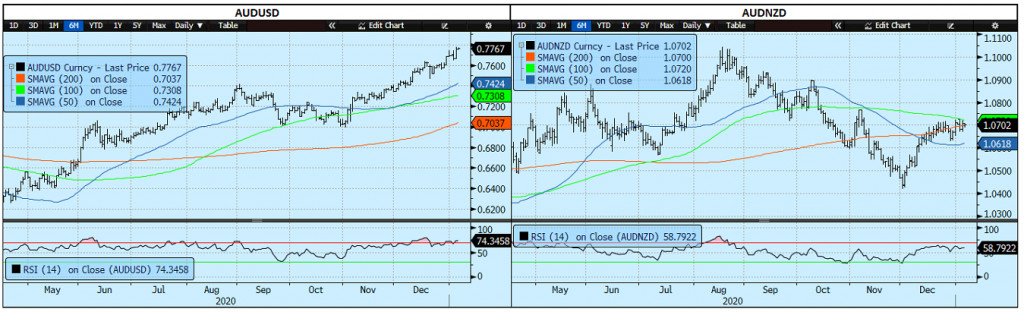

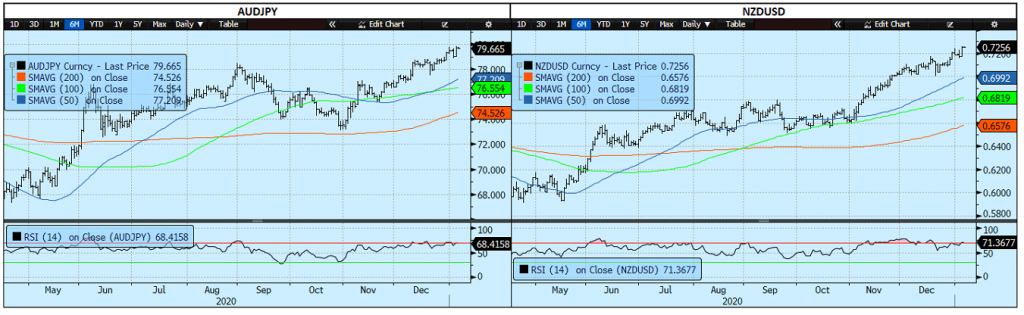

- In the immediate term, COVID concerns could well spike risk aversion and a potential pull back in AUD/USD towards 0.74/0.75. However, longer term we continue to favour a sustained depreciation of the Greenback in 2021, and 0.8000 could well be achieved by April.

- Given the nature of fiscal and monetary stimulus post COVID, hard asset prices and commodity prices are expected to continue their rally in 2021 which will also provide support to the AUD more broadly, despite its lack of a yield advantage.

Contact the Inside Track Research Team for more info: +61 2 8916 6115

The information contained in this report is provided by Rochford Capital Pty Limited – ACN 143 601 594, AFSL 361276. This report is provided for general information purposes and is solely intended for use by persons who are Australian wholesale clients. To the extent that any recommendations or statements of opinion constitute financial product advice, they constitute general financial product advice only. As such, any advice contained in this report does not take into account your objectives, financial situation or needs. You should consider whether this advice is appropriate for you, and seek independent professional advice before making any investment decision. Past performance is not indicative of future results.