Market Update: 21 September 2020

As tech continues to consolidate despite no news/ok news and perhaps some back of mind concerns of 2nd waves in Europe, we find everything else becomes stuck in a holding pattern.

As mentioned, a string of uncertainties on the horizon tends to force reassessment and levels of conviction.

That’s not to say it’s a bad thing… AUDUSD in a 0.7260/0.7340 range for almost 2weeks is neither bad for importers or exporters. Yes, both could get better levels, but consistency does help give chance to assess and execute in a more timely manner. Will this last? certainly not.. but perhaps we’re in the eye of a storm. With a cheapened costs, options are worth considering – now vol is priced closer to 9% than its peak of 32%… but hey, January was more like 5% so it’s not that cheap. Perhaps your starting point is going to alter your perspective.

Nonetheless, riskies (aka 25 Delta Risk Reversals) compare the cost of upside (Call) options against the cost of downside (Put) options. At present, they’re in negative territory – meaning Call options are cheaper…. but they have been for some time. They’re just a bit cheaper than August, early September. What does this mean? well with a few upcoming risks, it’s worth exploring.

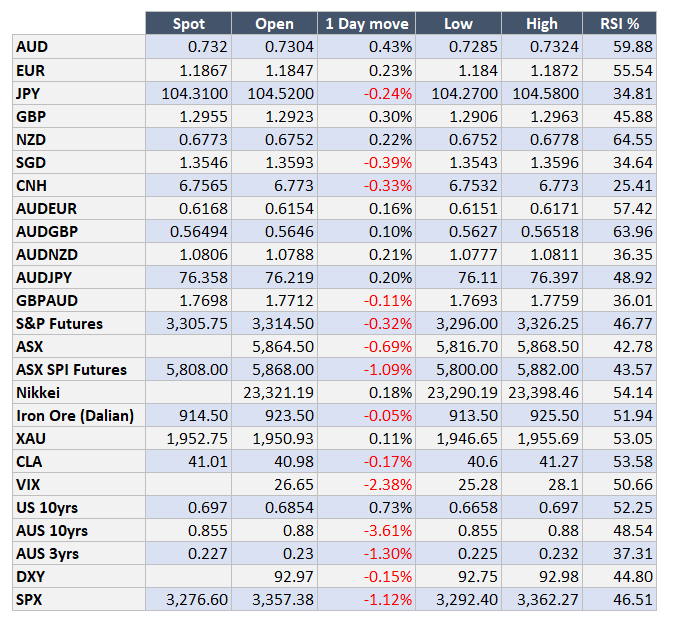

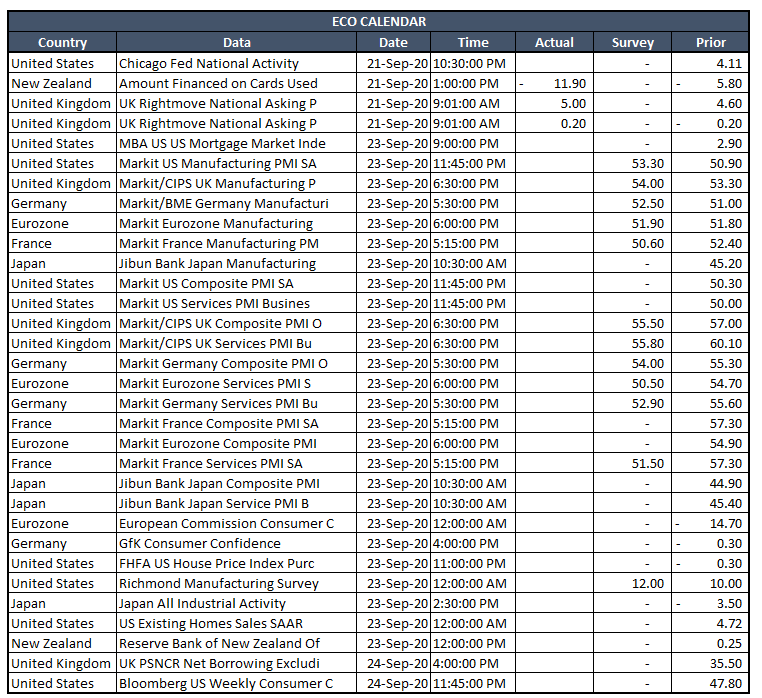

The week ahead brings EU PMIs, FOMC’s Powell has a few senate speeches and locally, RBA’s Guy Debelle is talking. I think though unless the markets have misinterpreted the many other times CBs have spoken, not much should sway markets. Have a great week ahead!

Contact the Inside Track Research Team for more info: +61 2 8916 6115